Industry snapshot – a look into medical buildings

We’ve collated an overview of different viewpoints on medical office buildings (MOB) investments to provide a balanced perspective to potential investors. Look out for our upcoming industry report on medical real estate. Click below to register for the alert, and we’ll send it out when our industry report is available for download.

Medical office buildings: asset class

Think of upward growth in recent years followed by increased demand for outpatient services, including a consistent and robust performance. That’s one of the many reasons why the medical office buildings (MOBS) asset class remains a popular choice for investors. A subset asset class,1 MOBS are featuring strongly in investment portfolios of experienced real estate investors as global healthcare demands increase. This asset class has evolved to cater for tenants in the medical field to consult with patients and perform various surgical procedures.

In this article, we examine the opportunities for investing in medical office real estate and how this asset type is maintaining its strong performance during the COVID-19 pandemic.

Medical buildings perform well

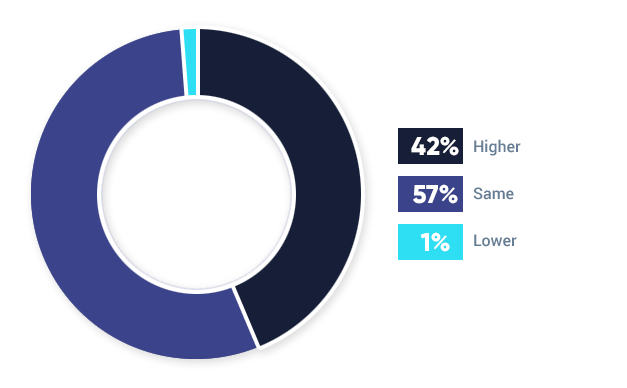

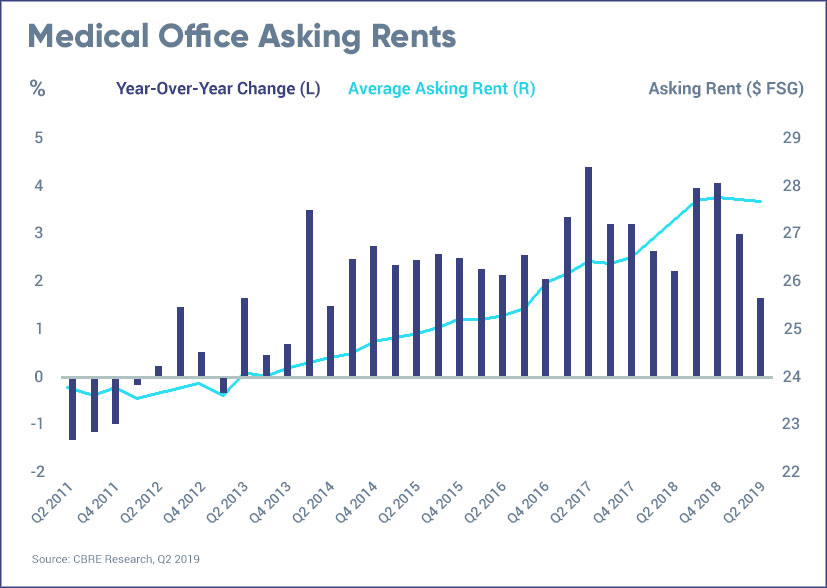

According to EquityMultiple, “compared to other asset classes, and the overarching office class specifically, MOBS generally exhibit uniquely steady long-term occupancy rates.” 2 CBRE’s 2019 Healthcare real estate investor and developer survey revealed that 99% of commercial real estate (CRE) firms in 2018 and 2019, found the occupancy of their medical office portfolios either remained stable or increased.3 The growth of MOBS has been significant as can be seen in the graphs below.

EquityMultiple also found the average rental price for 2018 jumped to $23/SF, amounting to a staggering 1.4% yearly increase.4

Outpatient healthcare

Outpatient healthcare is simply services outside of a hospital, from a clinic to a private practice that includes the diagnosis, observation, consultation, treatment, intervention, and rehabilitation of medical conditions.5 The advancement of medical tech has enabled clinical innovation and more specialised treatments.

These EquityMultiple statistics reveal the upwards growth curve for outpatient healthcare services:6

- The number of outpatient centres across America increased 51% from 2005 to 2016, with no signs of this slowing down

- To keep up with the demands of local healthcare, MOBS are being rapidly developed

- 2019 was a pivotal year for MOBS in Chicago, Cleveland, the Inland Empire region, and Atlanta, as these regions reflected the most growth

Healthcare services and the effect of COVID-197

Access to healthcare is a significant need for all. Telehealth has been viable alternative to traditional medical services during COVID-19, but doctors can’t practise all branches of medicine effectively with only virtual patient check-ups. While COVID-related closures have affected the healthcare industry, there will no doubt be a surge in services, due to patients that need basic and specialised treatments during and after the pandemic. Patients diagnosed with hypertension, diabetes and diabetes-related complications, cancer, and cardiovascular conditions have suffered from a lapse or lack of healthcare services since the COVID-19 pandemic.8

The challenges of investing in medical office building assets9

Before we look at the challenges of investing in medical office building assets, it is important to understand what type of medical office buildings we’re referring to as assets.

HBRE, a healthcare real estate firm has a clear understanding of the MOB sector:

- Hospital campuses – by necessity are large spaces that are costly, as various equipment and machinery need to be on for the hospital to function. These facilities also need a secondary power source for emergencies and specific requirements for plumbing, electricity and so on, to accommodate the many people that use the healthcare services daily.

- Medical offices – like hospitals these spaces also have the same requirements but are set to a smaller footprint. If a medical office building is more than 250 yards from the hospital, the hospital outpatient department (HOPD) can’t claim reimbursement rates. There is provision for an off-campus HOPD, but the site still needs to be within 35 miles of the main campus.

- Retail medical offices – only treat patients with acute illnesses, this service is specialised and may not offer the full range of healthcare options that a hospital does.

Global healthcare: 202210

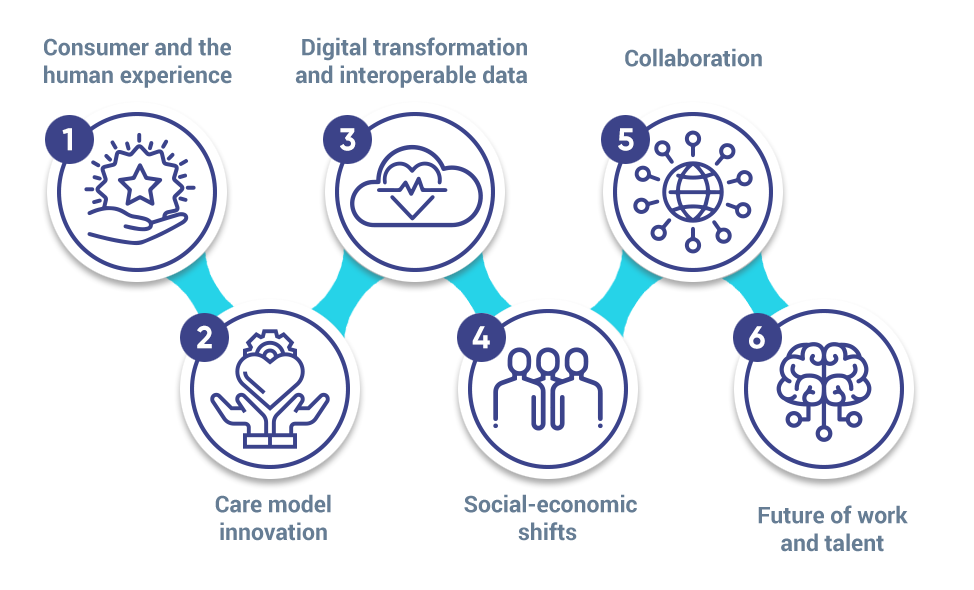

Deloitte’s 2022 Global Health Care Outlook focuses on six main factors that will influence health outcomes. While we acknowledge that everyone will have their own needs and services, this lends itself to the realisation that organisations in this industry must start to personalise healthcare experiences.

We’ve included a summary of this list:

The model of care has changed from a focus on the physical body only to a patient’s mental state and general well-being. From using health data to track and monitor the patient’s health with their consent, to a sense of empathy in how healthcare is provided, healthcare has pivoted due to COVID-19 to include more at-home prescription deliveries, remote consultations, and digital diagnostics. IT systems that offer this convenience of real-time data offer clues to behavioural research, patient habits, and even link people to a like-minded community where healthcare organisations and companies have more access to their patients’ lives than ever before.

Medical office building trends: America11

America’s aging population is growing by an estimated 36% according to the CCIM Institute, and those people will need at least three times the amount of healthcare services than younger people. A new law, the Patient Protection and Affordable Care Act, also gives 32 million citizens the right to health insurance. It can be safely assumed that this will have a positive effect on job creation among health care practitioners, which would lead to growth in demand for medical office buildings.

America is a good location for medical office buildings12

Not only have health services have been partially or completely disrupted in many countries, but worldwide COVID-19 has also taken a physical, mental and financial toll. One thing that is clear, is the need to prioritise adequate holistic healthcare services for inpatients and outpatients alike.

Americans’ health status has regressed over the last year as many COVID-19 survivors suffer from long-term health issues due to the pandemic. During this crisis, opportunities arose as the industry evolves towards a seamless and integrated patient-provider relationship.

Colliers 2021 Healthcare Marketplace Report provides much-needed insight into how the MOB field is performing and where it’s doing well:

- The US MOB vacancy rate was 8.6% at the end of 2020, versus 7.8% in 2019

- In 2020, demand outpaced supply across the top 50 metro markets

- Average MOB triple net lease rents were $20.95 per square foot, up from $20.22 per square foot in 2019

- MOB deliveries in 2020 totalled 20.2 million square feet, down from 22.5 million square feet

- MOB sales volumes held up well in 2020, totalling $11.1 billion

The US market clearly shows high demand, and we believe that it has strong fundamental factors supporting investment into the MOB asset class. It’s for this reason that we believe the Hamilton-Young Medical Center makes for an appealing investment. Momentum Weatherly LLC’s acquisition of it provides an opportunity to invest in an American MOB with a strong rent roll, that’s generating immediate cash flows.

1 (March 2021). ‘Investing in office real estate’. Retrieved from EquityMultiple.

2 Angelini, C. (August 2020). ‘Medical office building real estate in focus’. Retrieved from EquityMultiple.

3 (2019). ‘2019 Healthcare real estate: investor and developer survey results’. Retrieved from CBRE.

4 Angelini, C. (August 2020). ‘Medical office building real estate in focus’. Retrieved from EquityMultiple.

5 Abrahams, K., Balan-Cohen, A., and Durbha, P. (August 2018). ‘Growth in outpatient care’. Retrieved from Deloitte.

6 Angelini, C. (August 2020). ‘Medical office building real estate in focus’. Retrieved from EquityMultiple.

7 Angelini, C. (August 2020). ‘Medical office building real estate in focus’. Retrieved from EquityMultiple.

8 World Health Organization. (June 2020). ‘COVID-19 significantly impacts health services for noncommunicable diseases’. Retrieved from World Health Organization.

9 (December 2020). ‘The pros and cons of each type of medical facility’. Retrieved from HBRE.

10 (2021). ‘2022 Global health care outlook: are we finally seeing the long-promised transformation?’. Retrieved from Deloitte.

11 Wassik, P., and Carlson, D. (2022). ‘Medical office trends: hospital affiliation is a strong indicator of MOB asset value.’ Retrieved from CCIM Institute.

12 Janus, S., Seaward S., and Larson, N. (April 2021). ’2021 Healthcare marketplace report’. Retrieved from Colliers.

Industry snapshot – a look into medical buildings Read More »