Real Estate Investments Unlock Financial Freedom

South Africans are struggling to achieve financial freedom with 34% not having enough savings to last more than a month if they lost their income/jobsi. However, this freedom can be within reach through investing in quality assets such as real estate to build up a passive income.

“Financial freedom means having sufficient savings, investments, and cash on hand to afford the lifestyle you want,” says Scott Picken, Founder and CEO of Wealth Migrate, a leading fintech real estate investment platform. “Simply put, it’s the freedom to choose, and a steppingstone towards this is to build a passive income which is derived from investing your money in a product that generates profits, creates stability, security, and ultimately, freedom in your financial life.”

When it comes to ways that people have been supplementing their income, Picken explains that investing in cryptocurrency such as Bitcoin has been rising over the past couple of years. “It is important to note that although you can secure a triple return on investment, the only way to get your money out is to sell.”

He points out that real estate is one of the tried and tested investment vehicles through which people can earn a passive income. “In fact, 49% of the world’s wealth is held in property where people not only create their wealth but protect it too. However, only 12% of the global population has access to residential real estate and less than 1% has access to commercial property, which is where the real wealth is.”

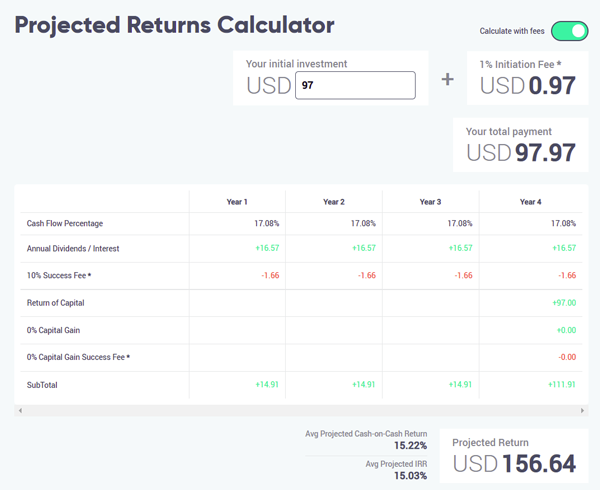

“It is for this reason that Wealth Migrate has reduced its minimum investment fee from $100 (approximately R1,570) to $10 (approximately R157) to give more South Africans greater access to the global real estate market,” says Picken.

To assist new investors to get their foot in the door and work towards financial freedom, he shares six steps to real estate investing:

- Belief: Henry Ford has been quoted as saying ‘whether you think you can, or you think you can’t – you’re right’. And the same applies to the belief that investing will help you find financial freedom.

- Knowledge: The next step requires the investor to do research and to learn about the properties in which they would like to invest.

- Accessibility: This refers to the action of investing – you can have all the knowledge about your desired investment, but unless you actually do something with it, it’s useless.

- A system: Next, your system is what helps you manage your portfolios.

- Accountability: As with anything new or difficult, the chances of doing it on your own are very small, but an accountability partner can help.

- Results: This is the profits from your investment. If you want to get wealthy, you’ve got to get results.

“Potential investors often believe this is a linear progression, but in fact it’s spiral, because once the results of your investment have been realised, you can go back to step one and reinvest all over again with a strengthened belief. I call this an upward spiral,” explains Picken.

“The challenge is that it works the opposite way too,” he says. “A downward spiral exists because if the belief, knowledge, access, a system, and accountability are not there then you get no results. No one learnt to walk by reading a book, they did so through action, and I believe that the same applies to achieving financial freedom.”

Picken shares that wealthy people prosper due to the habit of consistent investing. “Our philosophy is that, by dropping the minimum investment from $100 to $10, we can give a lot more people the opportunity to participate in the property market and start their journey to financial freedom. Over and above accessibility, we are giving them the ability to diversify their investment, enabling them to invest in 10 deals and assets across various countries and currencies.”

He adds that by lowering the minimum investment fee, this also gives investors the opportunity to reinvest what they earn from their investments more easily.

“To achieve financial freedom, South Africans need to take action and invest. Now is the time to take the next step,” concludes Pickens.

The minimum investment fee will be $10 only until the end of May 2022. For more information, or to invest, go to https://wealthmigrate.com.

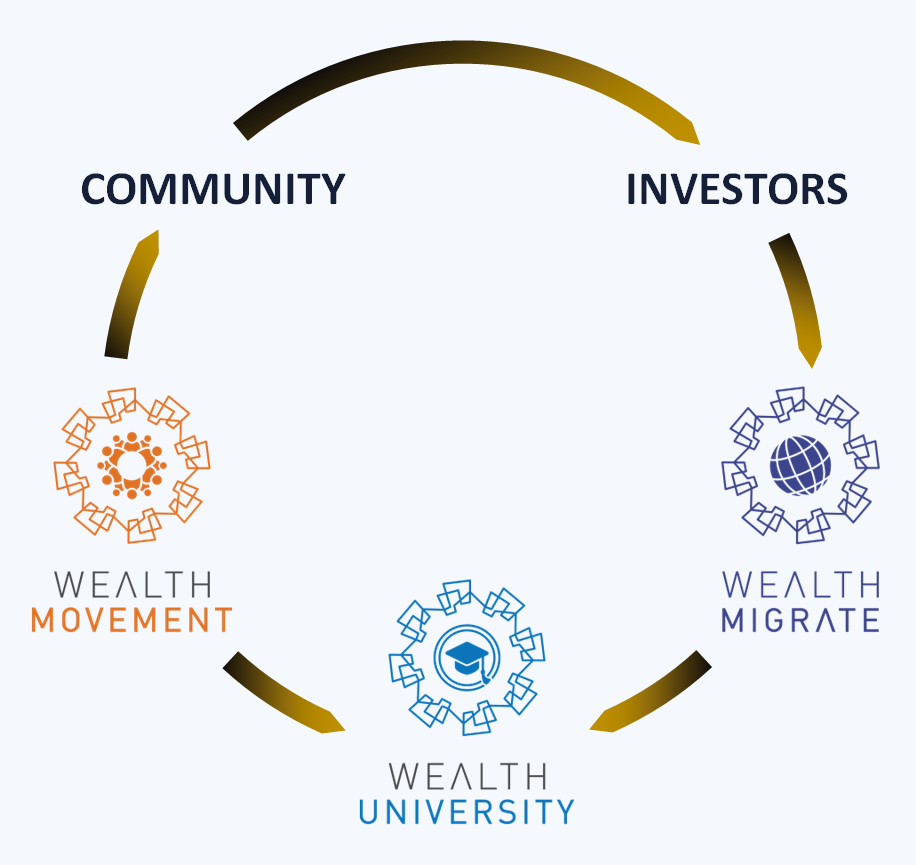

About Wealth Migrate

Established in 2010, Wealth Migrate is a leading fintech real estate investment platform that helps the 99% invest like the top 1% to create more financial freedom in their lives. In so doing, the company is closing the wealth gap, brick by brick. Wealth Migrate’s mission is to put the power of smart investing in everyone’s pockets by providing people with a safe and easy way of not only investing in residential and commercial real estate markets globally, but also by diversifying their investment. This is achieved through the use of technology and crowdfunding. For more information, or to invest, go to https://wealthmigrate.com.

Real Estate Investments Unlock Financial Freedom Read More »