Activate your investor mindset with Wealth Migrate insights

Learn about the importance of diversifying your assets for the 100-year life

Wealth Migrate’s Chief Investment Officer, Riaan van der Vyver explains his perspective on financial planning with increased longevity in mind. He provides insights on why he believes diversification is the way forward and why it’s never too late to start becoming financially literate. A 100-year life will give you more time to build a foundation to create and protect your wealth, and by adapting an investor mindset, it will accelerate this process of wealth creation.

For a broader picture of the problems we have identified with the 100-year life and how it is affecting financial planning, read this article on the 100-year life. Where we discuss how investors need to accept that a 100-year life means having a new mindset for achieving financial freedom, which works together with financial independence.

Lead with a diversification investment strategy

Certainly, in the global markets there is a lot of uncertainty and volatility, Russia’s war with the Ukraine is causing worldwide supply shortages, and most economies are still recovering after the COVID-19 pandemic. Investors need to pivot investment strategies in order to lower investment risks and diversification may be the best defensive play for investors considering these types of market concerns.

Diversification is important to investors as it is a way of harmonising the risk-reward ratio and capitalising on beneficial investor opportunities.1 Allocating capital into a variety of assets lowers risk exposure when it’s based on an investor’s personal comfort level with risk. When an investor builds their portfolio, they choose investments aiming to earn a high return for lower risk.

Alternative assets are often attractive because of the types of returns they can offer, and the opportunity they provide to diversify an investment portfolio that may already include traditional investments. Therefore, this reduces overall portfolio risk.

Understanding alternative assets

I hear a lot about the fear of not knowing enough or not knowing how to leverage information to make the best investment decisions. That’s why I personally believe that financial literacy is important to unlocking future wealth creation and protection. Before I go into what the future holds for alternative assets and the potential growth for this industry, I will explore these investment concepts in more detail.

- Portfolio diversification

Alternative investments generally have a low correlation to more traditional asset classes. Alternative assets offer portfolio diversification, lowering the overall risk exposure across investments, and provide a hedge against inflation.

- Improving returns

There are other reasons as to the appeal of alternative assets to investors, one of these is the possibility of gaining high returns. Traditional assets, especially in the current bull market for stocks and shares offer lower returns, the trade-off is that alternative investments generally require a higher amount of capital for investment for a longer term.2

However, Wealth Migrate has managed to remove the barrier of high capital by ensuring that our investors can pool wealth together through a crowdfunding vehicle. This grants more investors the accessibility option of investing in alternative assets, as previously this used to be restricted to the ultra-high net worth investors that could afford to invest by themselves.

You may have heard of absolute returns and relative returns. These are the performance measures that fund managers use to determine whether an investment is providing good returns.

Investopedia defines these types of returns as:3

- Absolute returns are whatever the asset or portfolio returned over a specific time period

- Relative returns use the difference between an absolute return and market performance as a comparable benchmark, also known as alpha

Absolute returns

A fund manager will aim to diversify an investment portfolio across and in asset classes, geographical locations, and economic cycles. The goal is to balance out the risk and reward ratio and stabilise the investment portfolio to withstand market complexities and downturns. This return is measured simply as a profit or loss, and absolute returns tend to be investments that cover a shorter term.

Relative returns

These returns measure the performance of actively managed funds and should in theory earn a higher return than the market average. Relative returns are used as benchmarks for a fund manager’s performance. Fund managers will rely on proven market trends to achieve these returns, along with carrying out a detailed economic study on global and local businesses to justify this approach.

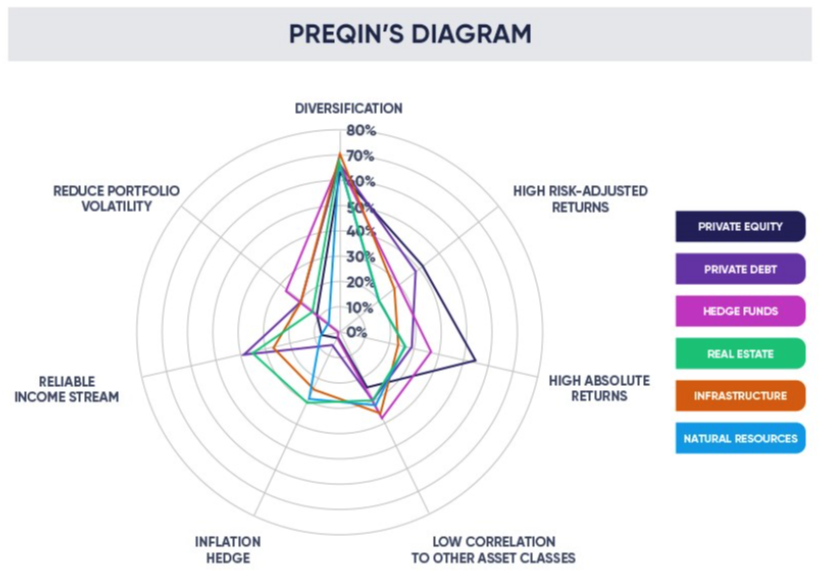

Preqin defines alternative assets as either ‘return enhancers’ or ‘return diversifiers’:4

- Return enhancers are assets that are expected to generate a higher-than-average return

- Return diversifiers are assets that have a low correlation to other assets, and tend to lower investment risks across the overall portfolio

Preqin’s diagram shows the main reasons for investing in alternative assets:5

Managing risk and returns

As an investor you need to know what your risk appetite is. In simple terms, can you afford to lose the money that you put into an investment? Investors will bear some sort of risks with investing, and you need to face this truth head on, that you could lose the entirety of your investment.

There are ways to manage the risks you are willing to take:

- Analyse your current and future commitments, (what must you invest in versus what you want to invest in)

- Ensure you give your investments enough time to mature and produce the returns offered, (this may mean riding out turbulent markets and fighting the fear to take your money out early)

- Knowing how much investment capital you can afford to lose

Essential investment strategies

While there are a multitude of investment strategies that you can use, once you know what your risk profile is for an investment, this can be used to maximise your returns.

MoneySense is Singapore’s national financial education programme and it lists three basic investment strategies that investors should use:6

While in previous articles we have explained what diversification and asset allocation is, let’s briefly look into what dollar-cost averaging is. This is a technique to invest a fixed sum of money for regular periods whether the market is performing well or badly. Although the market may fluctuate during these periods, over the long term it should result in a lower average cost per investment. This also ensures that you start having the discipline to set aside a budget for investing and actually invest, therefore, promoting healthier financial habits.

Risk appetite: diversification and low correlation

Alternative assets appeal to investors with a high risk and long-term reward profile. Alternative assets can be classified as high risk, as the barrier to investment usually requires a sizeable sum (something we have overcome with Wealth Migrate). If that investment did not pan out a single investor could lose $300,000 (USD) or more in one go, however, along with the risks come the promise of higher returns. Therefore, more investors are choosing to invest in alternative assets, since traditional assets are not performing well now, and alternative assets hold a longer-term promise for higher returns.

The risk to reward ratio is therefore preferential for investors that incorporate alternatives within their portfolio to spread risk.7 Depending on the length of commitment, investors can achieve rewards far surpassing capital they have allocated within the industry. If investors want to diversify their investment portfolios this means they want low correlations.

Investors generally have a target for how much each investment must return, by targeting low correlations. This ensures that the whole investment portfolio is not at risk if one market, asset, or investment strategy does not work, and the overall investment portfolio is stabilised and produces reliable returns.

The future of the alternative assets industry

Preqin’s Alternatives in 2022 report is why I can confidently predict that alternative assets are here to stay and should be a vital component of an investment portfolio.

Here are statistics that Preqin published:8

- Alternative assets surged ahead in 2021, with record levels of fundraising, investment, exits, and performance across many asset classes

- Preqin expects alternative assets under management (AUM) to grow from $13.32 trillion (USD) today to hit $23.21 trillion (USD) by 2026

- With growth accelerating over the next five years in:

• private equity (2021-2026 CAGR of 15.9% vs. 10.2% for 2010-2020)

• private debt (17.4% vs. 12.8%)

• infrastructure (16.6% vs. 15.9%) - We also expect real estate, natural resources and hedge fund AUM to continue to grow over the next five years, but at a slower pace compared with 2010-2020

This means in four years the industry is expected to double in worth. As an investor I would want to ensure that I have alternative assets in my investment portfolio, considering the rapid growth and levels of demand for alternative assets.

The overlap between living longer and investing more

While I believe I have given a solid overview of the case for investing in alternative assets and the benefits of diversification, I have not touched enough on the longevity of a 100-year life and what this means for you. Obviously, the added longevity of a 100-year life leaves you more time, and truly, for most investments (specifically for long-term ones), this is exactly what you need to create and preserve wealth. The 100-year life gives you more time to gain experience in investing and find out what works for you, as each person’s financial goals are different.

There is not one solution that will get you to where you need to be financially, and that leaves a lot of room for exploring what you want to invest in and what you feel comfortable with investing in. Some investors take a longer more cautious approach by dipping their toes in the water, and others will plunge headfirst into the deep end of the pool. Upskilling your investor knowledge takes time and practice, very few people that do not have a financial background (and even those that do), get this right from the start. The good news is that with a longer life, time is now on your side.

Informed investing is a trial-and-error game and even though you may diversify your investment portfolio, investing by its very nature still carries some risks.9 Not all your investments will pan out the way you expect them to, some may perform better or worse, or give an average return. While this sounds scary, it is crucial to realise that in today’s world, every investor has access to more knowledge and tools than in previous generations to learn how to invest. The extra time also allows you to learn from your initial mistakes, do not be afraid to take some risks with investing, but be wise in your approach to investing.

My opinion on becoming more seasoned investor

From my own experience as an investor, my advice would be to take your planned investment funds and split them into traditional and alternative assets. While traditional assets in the current environment are not performing as well as they have in the past, they tend to be steady investments (depending on how risk averse you are).

When it comes to alternative assets, set aside money that you can see is going to be a more certain bet. For instance, structured notes are performing better right now as these generally offer capital protections for your investment as well as higher than average returns. In a worst-case scenario, these will at least return your initial investment amount, although this may rely on the performance of the underlying reference basket. If the performance has been bad over the set time period, a proportion of your initial investment amount may be returned.

Then set aside money for investing in alternative assets that you are taking a gamble on as this is part of the learning curve; if you never try, you will never know how it could have turned out. I do not recommend going into debt for this, but there are investments that take lower minimum amounts where you can trial investments that you are not sure of, or how they will perform.

The 100-year life will amplify the need to leverage financial institutions, investor communities, and mentors to upskill investors in financial literacy. Becoming financially literate will take away the barriers to understanding how to make your money work for you, and vitally, the myth that becoming financially independent and having a financial freedom mindset is only available to the elite of the upper class.

Find more Wealth Migrate content:

Read our investment articles and listen to the podcasts. We cover the topics of diversification, structured notes, purpose-built-co-living, industrial real estate, and planning for a 100-year life.