Learn how Society 5.0. and Diversification 5.0 connect

Find out what investment asset allocations contribute to the wealth pyramid

Wealth Migrate’s understanding of diversification has gone deeper into refining it. While Ray Dalio’s thoughts on diversification provide a good foundation, we’re examining exactly what diversification is and how it fits into the future for our investors.

To recap, our previous article on diversification focused on examining the reasons for taking a balanced approach. Dalio’s advice for investors is to maximise risk resiliency without lowering expected returns, simply put, “Diversify between currencies, asset classes, and countries as the best way to reduce risk without reducing opportunity.”1

Diversification 5.0

We have taken this belief one step further by redefining diversification to include diversifying in currencies, countries, and partners, while also including diversifying in and across asset classes. Diversification 5.0 as we’re calling it, is a refinement of Ray Dalio’s original investment strategy to make it more future proof. This reasoning relies on future-proofing investments for Society 5.0 and understanding how the asset allocations need to rely on future returns and timelines.

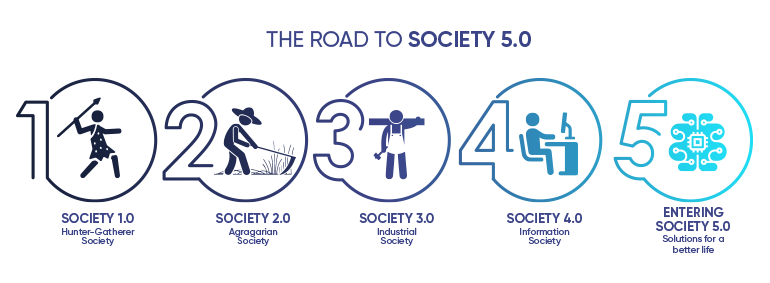

In 2016, the World Economic Forum predicted that society was already at the precipice of The Fourth Industrial Revolution with rapid advances in tech being a gamechanger for all facets of human life.2 Now, we are again looking ahead to how we think society will progress and Japan’s prediction is that society will go further than the current information age3 and digital transformation of manufacturing in the Fourth Industrial Revolution or Society 4.0.4

Definition of Society 5.0

Japan’s vision of Society 5.0 was first proposed in the fifth Science and Technology Basic Plan,5 it centres upon the idea of digital transformation from within and across society. This vision is of a super-smart society that defies the physical boundaries of space in cyber-space and is powered by tech through big data analytics, artificial intelligence (AI), the Internet of Things and robotics.6

Japan’s Council for Science, Technology and Innovation defines this as, “A human-centred society that balances economic advancement with the resolution of social problems by a system that highly integrates cyberspace and physical space.”7 While Society 5.0 may sound like a futuristic ideal, we must acknowledge that tech has evolved and progressed with even further speed and purpose since achieving Society 4.0’s milestone.

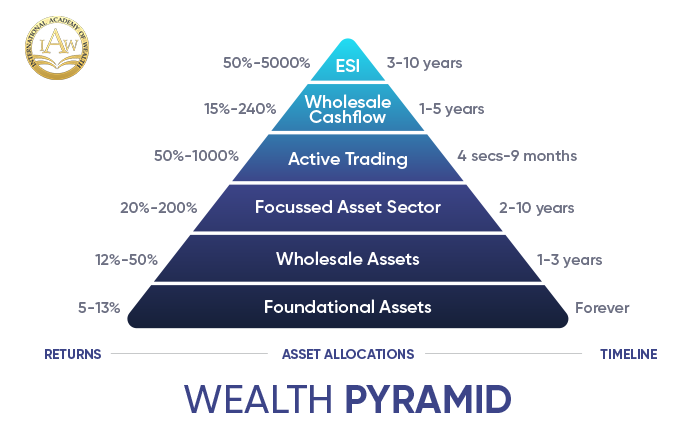

The wealth pyramid goes beyond the asset allocation strategy outlined by Dalio to include diversification across different types of returns and separate holding periods of assets. It is all about creating a wealth pyramid formula that will weather the current and future volatility of the markets, and the progress of change to Society 5.0.

What alternative assets are

Alternative assets are not traditional financial assets such as stocks, bonds and cash. Rather alternative assets encompass a range of asset types from private equity to venture capital, hedge funds and managed futures, collectables from art to antiques, as well as commodities and real estate.9

A quick overview: the rise in demand in alternative assets

The rise in demand depends on many market factors that are affecting the popularity of investing in alternative assets, but here’s a quick summary of the biggest drivers.10

- Investors want less volatility and more stability in their investments.

Connection Capital published a survey in 2020, where it found that 87% of private investors were planning on maintaining or increasing their allocation to alternative investments over the next 12 months.11

- Inflation is causing investors to consider investing in alternative assets.

Fear of inflation has driven the change in investment strategies and tactics. Bloomberg’s editorial by Mohamed El-Erian on the inflation debate, taps into statistics that America’s inflation may rise to 2.9% through June 2021 and then gradually decrease to about 2.2% in 2022.12

- The alternative asset market is in a bull run (upwards projected growth).

This is good news for investors that are looking for high returns for their investment portfolios. Preqin has collected data that shows alternative assets have had record growth over the last 10 years, growing from $3.1 trillion (USD) in 2008 to more than $10.2 trillion (USD) by 2019.13 In fact, Preqin predicts this will reach a staggering target of $14 trillion (USD) in 2023.14

- Global stocks on the S&P 500 are extremely expensive and investors can expect lower returns.

Penta’s data from September 2020 proves that the giants in the S&P 500 amounted to nearly 25% of the total gains, namely: Alphabet, Amazon, Apple, Facebook, and Microsoft.15 While the S&P 500 has performed well over the last 10 years, experts don’t believe that this trend will continue. Warren Buffet’s famous market gauge reached an all-new high at 195%, a clear warning that global stocks are overpriced and could crash soon.16

Traditional investments are still going undergoing a lot of volatility in the markets and while it may take some time for the factors such as COVID-19 and its effects on the global economy to settle, this is making alternative assets look more appealing and safer options for investment. This is particularly true where traditional assets are now providing lower interest rates for returns.17

- Using a diversification investment strategy to counter market uncertainty offers more rewards.

The reasoning is simple, a balanced investment portfolio will yield returns on diversification if the basket of opportunities is uncorrelated. This is a strategy that even the wealthiest of investors follow, The Motley Fool found that ultra-high-net-worth investors that have a net worth of at least $30 million (USD), have on average 50% of their assets in alternative investments.18

In our opinion, a diversified portfolio includes a mix of traditional and alternative asset investments. When investors allocate globally diversified assets in their investment portfolios this balances out the risk-adjusted returns. From independent financial advisors to portfolio managers and fund analysts, this neutral approach also ensures that it’s also easier to achieve a benchmark of funds for their clients.

Understanding the wealth pyramid and its diversification strategy

Our partner, Mark Robinson from the International Academy of Wealth, is the creator of the wealth pyramid20 and it’s through this tool that we can assist investors with understanding how to diversify a global investment portfolio. Robinson has over 23 years of experience in the financial services industry, and he’s also the founder and Chief Executive Officer of the International Academy of Wealth – an online education platform that equips users with the know-how to make smart investment decisions.21

The wealth pyramid is a formula that staggers timelines of investments and returns, and this ensures investment growth is working in the investor’s favour. We go into more detail below on how the wealth pyramid’s layers will ensure that an investor’s asset portfolio is globally diversified. For more information on how this works, view the Diversification 5.0 recorded webinar with Picken and Robinson.

A breakdown of the wealth pyramid and how to structure your investment portfolio:

1. Foundational assets

• These are assets that investors plan to keep long-term for the returns and not sell

• Aim for target returns of 5%-13%

• It includes the following assets: real estate, gold or silver, and crypto staking

2. Wholesale assets

• These are assets that investors plan to keep for one to three years

• Aim for target returns of 12%-50%

• It includes the following assets: real estate

3. Focused asset sector

• These are assets that investors plan to keep for two to 10 years

• Aim for target returns of 20%-200%

• It includes the following assets: distressed securities (shares) and early-stage Active Research Knowledge (ARK) funds

4. Active trading

• These are assets that investors plan to keep for four seconds to nine months

• Aim for target returns of 50%-1,000%

• It includes the following assets: stock market (equity securities) and cryptocurrency

5. Wholesale cashflow

• These are assets that investors plan to keep from one to five years

• Aim for target returns of 15%-240%

• It includes the following assets: structured notes (debt securities), yield farming and crypto trading bots

6. Early-stage investing (ESI)

• These are assets that investors plan to keep from three to 10 years

• Aim for target returns of 50%-5,000%

• It includes the following assets: early-stage or late-stage venture capital and cryptocurrency

Diversification 5.0 is an investment strategy for investors to pivot wealth creation and preservation by using the wealth pyramid as a tool for developing a well-diversified investment portfolio. Wealth Migrate has taken advantage of the benefits that tech provides by creating a FinTech platform that is accessible to all, which is financially regulated not only in South Africa but also in Europe.

Tech is driving the future of society and even now is creating disruptions by allowing businesses to offer more profits by running leaner in costs and cutting out middlemen, while still adhering to trust and transparency processes. With Society 5.0 on the horizon and digital transformation becoming a necessity, it’s time to transform the way investors create and preserve wealth.

As part of our ongoing educational series, our next article will explore how tech can assist investors in easily creating a secure and globally diversified portfolio that is future-proof.

You might also be interested in

Read our first article on diversification: The role of diversification in uncertain times

1 Robbins, T. (February 2017). ‘Unshakeable: your financial freedom playbook creating peace of mind in a world of volatility. Retrieved from Unshakeable.

2 Schwab, K. (January 2016). ‘The Fourth Industrial Revolution: what it means, how to respond’. Retrieved from World Economic Forum.

3 Council for Science, Technology and Innovation, Government of Japan. (2016). ‘Society 5.0’. Retrieved from Cabinet Office.

4 Council for Science, Technology and Innovation, Government of Japan. (2016). ‘Society 5.0’. Retrieved from Cabinet Office.

5 Council for Science, Technology and Innovation Cabinet Office, Government of Japan. (December 2015). ‘Report on the 5th Science and Technology Basic Plan’. Retrieved from Cabinet Office.

6 UNESCO. (April 2022). ‘Japan pushing ahead with Society 5.0 to overcome chronic social challenges’. Retrieved from UNESCO.

7 Japan’s Council for Science, Technology and Innovation. (2016). ‘Society 5.0’. Retrieved from Cabinet Office.

8 Dodig-crnkovic, G., and Burgin,M. (April 2019). ‘Philosophy and methodology of information: the study of information in the transdisciplinary perspective’. Retrieved from Google Books.

9 Caporal, J. (August 2021). ‘81% of ultra-high-net-worth individuals use alternative investments.’ Retrieved from The Motely Fool.

10 Milinchuk, A. (April 2021). ‘Five reasons alternative investments are taking off.’ Retrieved from Forbes.

11 Cowley, B. (May 2021). ‘Private investors increase allocations to alternative assets in push for diversification and outsize returns.’ Retrieved from Connection Capital.

12 El-Erian, M. (March 2021). ‘Opinion: Faster inflation is coming. How bad will it be?’ Retrieved from Bloomberg.

13 Preqin. (2022). ‘The past present and future of the alternative assets industry’. Retrieved from Preqin.

14 Preqin. (2022). ‘The past present and future of the alternative assets industry’. Retrieved from Preqin.

15 Csernyik, R. (March 2021). ’Future returns: investing beyond the S&P 500.’ Retrieved from PENTA.

16 Mohamed, T. (April 2021). ‘Warren Buffett’s favorite market indicator soars to record high, signaling stocks are overvalued and a crash may be coming’. Retrieved from Markets Insider.

17 Milinchuk, A. (April 2021). ‘Five reasons alternative investments are taking off.’ Retrieved from Forbes.

18 Caporal, J. (August 2021). ‘81% of ultra-high-net-worth individuals use alternative investments.’ Retrieved from The Motely Fool.

19 Csernyik, R. (March 2021). ’Future returns: investing beyond the S&P 500.’ Retrieved from PENTA.

20 Picken, S., and Robbins, M. (June 2022). ‘Wealth Movement – Diversification 5.0: creating a diversified portfolio that meets your goals’. Retrieved from YouTube.

21 Robinson, M. (2022). ‘Become financially free with the IAW wealth pyramid portfolio method’. Retrieved from International Academy of Wealth.