The future of finance and the 100-year life

Wealth Migrate’s Chief Marketing Officer, Mariken Jansen van Vuuren, has some thoughts on the future of finance and how we are managing our wealth creation and protection. Here’s her outlook on why planning for retirement is too late and the reasons for everyone to act sooner.

These are all questions we ask ourselves at some stage in our lives. Imagine where you see yourself in five years’ time:

- What does that picture look like?

- Where will you be?

- How is your lifestyle?

- Do you think you’ll be able to live the life you want without any restrictions, financial or otherwise?

- Now fast forward this scenario to 10 years, and then 20 years, what does your future hold as you get older?

The ageing society narrative is blown out of proportion with a crisis scenario where a ‘grey tsunami’ engulfs the economy. The worries that your funds won’t last until the end of your life from insolvency of pension funds and social security, are stark fears for many people. Unfortunately, what keeps this fear-based perspective going, is the idea that societal resources will be drained, and the downturn of economic productivity will be due to the actions of the older generation.

Planning for life after retirement

Rather than looking at financial planning from a place of fear, I have examined the facts. After finding numerous studies and statistics, my research shows that only 17% of people in America are saving for retirement.1 That should be of more concern to the worldwide population, as setting yourself up to achieve financial freedom needs to start before the worry of being able to retire.

Even more concerning is that most people do want to save up enough for retirement, but there is a misconception that they will not have enough money to retire comfortably.2 This is an alarming thought, because if most people cannot afford to retire on a normal lifespan (generally retirement age is at 60 years or 65 years), then they will not be able to retire if they have a longer, 100-year lifespan.

Living longer lives means you need to invest earlier

Thanks to the combination of advances in science, healthcare, and tech, people are living longer lifespans. However, there is not enough awareness on how much money a person needs to have upon reaching retirement. Just let that thought sink in, before we move onto the statistics of how people are tackling this financial hurdle.

Almost 70% of Americans aged between 45 to 54 years old claimed that they did not earn enough money to invest.3 This seems to be a popular belief for Americans as 62% of people aged between 55 to 64 years, and 61% of people aged between 35 to 44 years, thought that they did not earn enough money.4 It should be concerning that more than 50% of the population in the USA between the ages of 35 and 64 years felt that they do not earn enough money to invest,5 as these are the peak earning years for many workers.

People who are not earning enough money in this timespan are unlikely to make more money. Investing is also essential for people in this age group, because they are nearing retirement age, and most of them will not have enough savings for retirement. A recent survey from GOBankingRates published that 42% of Americans will have less than $10,000 (USD) in their savings when they retire, meaning they will essentially “be broke”.6

A deeper look into these findings shows more women are claiming to not have enough money to invest compared to men, (60% of women chose this response).7 GOBankingRates attributes this to the gender pay gap as the main reason behind the disparity, which ranges from an annual salary of $7,000 (USD) to $19,500 (USD) – and this figure depends on the location of where you work and reside.8 A startling fact from the survey revealed most men will not invest as they are afraid of losing their money, 12% of men chose this response compared to 5% of women.

Closer to home and proving this is a global concern, BusinessTech’s 2022 poll found over one-third of middle-aged South Africans (35%) are not saving any of their salary for their retirement.9 The 10X South African Retirement Reality Report of 2020, has data that proves almost half of South Africans (49%) did not have any retirement plans.10 Out of all the responses that claimed to have retirement plans, at least 75% worry if they will have enough funds to live on after retirement, or report feeling unsure about their savings.

The reality of a 100-year life

The good news is that people are living longer worldwide as global studies have shown that every generation is living at least three years longer than the previous generation.11 This poses a problem for society, as the amount of funds needed for retirement is now much higher to cover this longer life. Retirees have more pressure to ensure their wealth creation and protection efforts are successful in order to live the life of their dreams. Now, retirees will need to save up even more money than in previous years to lead a comfortable lifestyle while in retirement.

After reading the book, The 100-Year Life – Living and Working in an Age of Longevity by Andrew Scott and Lynda Gratton,12 I concluded that the book has missed an important stage. One aspect of this book is the focus on three stages of life: education, work, and retirement. In my view, it has missed a crucial stage – financial well-being and financial literacy. That’s the reason why I will be referring to the four-stage life, instead of the three-stage life.

In the fourth stage, the possibility of being financially secure (financial well-being) was more achievable for the generation of workers that were provided pension or provident funds as part of their salary package, and these work benefits would also cover medical aid, car allowances, and even home allowances (if you were lucky). With work offering all these benefits to employees, being a property owner was a more likely outcome than remaining a tenant and renting an abode.

While the total compensation for employees does vary according to skills and experience, companies, and locations – basic salaries in 2022 tend to offer less ‘financial benefits’.13 Whereas previous generations had this buffer, as even basic jobs generally included some form of contribution towards medical aid, a pension or provident fund, and allowances.

What the 100-year life means

I immersed myself in researching the book, The 100-Year Life to fully understand the effect it has on education while I was employed at GetSmarter, 2U. Recently, I went even further in my research to really come to grips with its effects in the present and looking forward to the future.

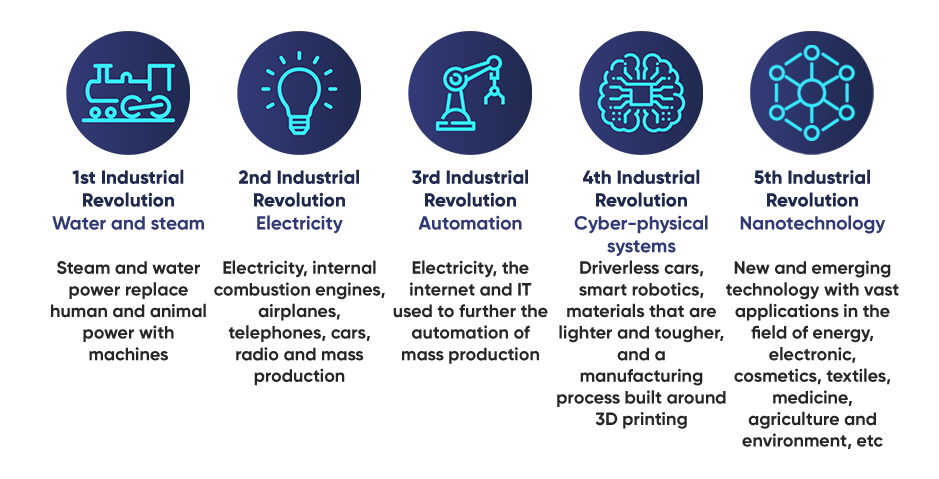

Let’s view how the world has changed over the past 100 years:14

Over the past 100 years, we have experienced four Industrial Revolutions, with a fifth one recently making its appearance and predicted to impact the next generation. Society has moved from steam and water to electricity and automation, and lives in a cyber-physical world. Progress from each revolution was made possible by advances in tech; steam trains replaced horses and carriages, electricity made new modes of transport, communication, and production possible (airplanes, phones, and conveyor belts), with mass production revolutionising the way people live and work around the globe.

Companies such as Alibaba have changed the way eCommerce interacts with suppliers, and Tesla factories in Texas utilise robotics and automation to manufacture parts. Humans have come a long way from the First Industrial Revolution, and society is no longer moving towards the Fourth Industrial Revolution, it is already here.

The future you imagined is real – in pop culture, science fiction films, and books. Now, you take for granted tech that enables driverless cars, smart robotics, and 3D printing. Alibaba even makes use of warehouses that are 100% automated. The Internet of Things is changing how you interact with your version of reality, as artificial intelligence is integrated into your daily tasks and ecosystems.

Here are my thoughts based on that research. Not only is society navigating its way through the Fourth Industrial Revolution, but people are also living longer thanks to breakthroughs in healthcare and science. Research has shown that as a global society, individuals are living three years longer every decade, this is affecting every sphere of life. The traditional four stages of life from education to work, and financial well-being to retirement will no longer exist. Rather the multi-stage life will be the new model.

A lifetime of continuous wealth creation and protection

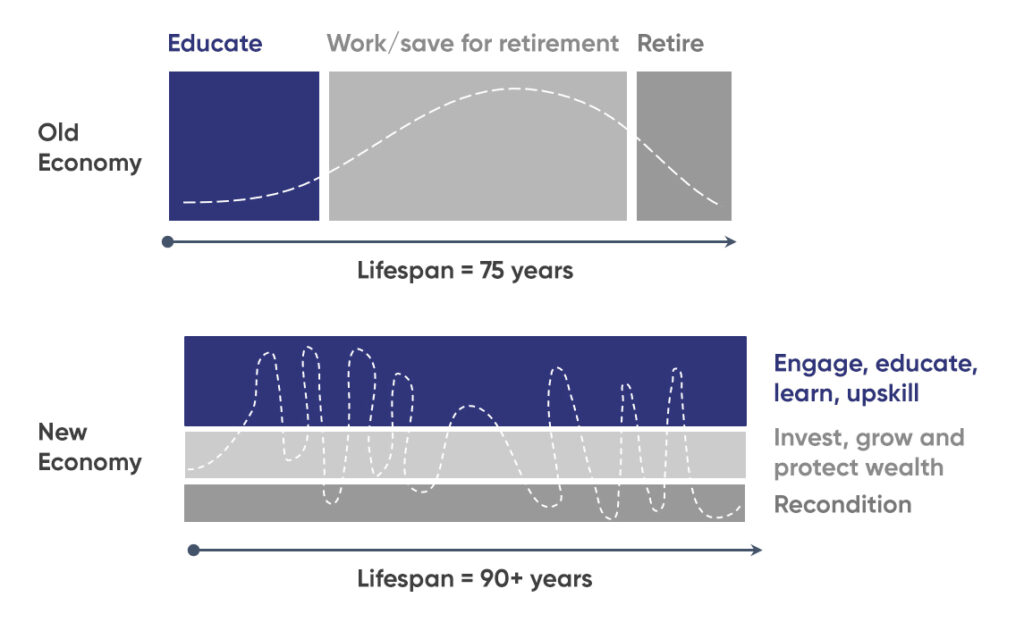

The graph below illustrates the old economy and the new economy

The old economy speaks to a four-stage life, a life that was certain. It was a life that felt secure, where you went to school, then maybe studied further to receive a good education. You applied for a steady job with a clear career trajectory, and you perhaps changed jobs once or twice, but generally found a company to work at for the rest of your life. Your job gave you a good package including a pension fund, and after that, you retired, and then you enjoyed what time you had left.

The main difference between then and now, is the longevity of our lifespan. People are living longer than expected and this creates its own challenges. For instance, both my grandmothers made it into their 90s, and one of them is still alive and healthy. A close friend of mine has a grandmother who is 100 years old this year, and she is still very healthy and able to look after herself. Not only that, a woman in a nearby village also made it to age 105.

The fact of the matter is the same people that followed the laid-out path in the old economy are now living longer and outliving their assets. That pension fund alone can no longer support them if they live to 100 years of age. This new phenomenon of living longer, along with the Fourth Industrial Revolution, has broken the mold of the traditional life stages. The three-stage model of life of finishing your schooling and receiving further education (usually one degree, if finances permitted, maybe more) then working for 40-plus years, being assured a pension fund, and retiring after 20 or so years, used to be sufficient.

You need to move to a multi-stage model where a more open and flexible mindset accepts this change daily. No longer are university degrees the main requirement for employability, as learning has changed. A university degree in some fields (particularly where tech is prominent), is almost immediately outdated when you enter the workforce. Jobs that you will populate tomorrow may not even exist in the future, and the skills we will need to do the jobs of the future, will require continuous learning. Upskilling and learning takes place all throughout life and this may be in many forms whether it is online, in-person, or from different institutions – technikons, universities, short courses, bootcamps, masterclasses, internships, mentoring – the list goes on.

The current social media generation changes jobs frequently. They transition often in their careers and most of them have side hustles that they started right out of school. The way you learn, the way you work, and the way you will retire has changed; that means your finances need to change as well.

Changing our financial mindsets

Society is privileged to be able to live longer. Although being poor, middle class, or rich will affect the opportunities and lifestyle you lead, most of the world’s population is increasingly likely to live to a robust age of 100 or more. I don’t know about you, but if I am going to live to be 100, and maybe even longer, I do not just want to survive; I want to thrive. The thing is, as your life expectancy increases, financing the older version of yourself becomes a challenge.

If you think about the old economy and the four-stage life, with an expectancy of around 80 years – you could work until age 65 while saving a manageable portion of your income towards retirement – if you are part of the mere few that do put money away for retirement. However, if you live to age 100, but only work until you are 65 years old, the portion of your income you need to save to fund retirement is around 25% of your annual income.15

That is an unrealistic amount for most people, especially in today’s economy. In this specific scenario, you would work for 44 years but be in retirement for 35 years. Now ask yourself truthfully whether you can support this. The more realistic reality with the shifts happening in the new economy is that people will more likely work into their 70s and 80s. There is a good chance that these people will transition into new careers, more flexible roles, side huddles, or gig work. Work before and after retirement is already becoming more fluid, and more people are choosing semi-retirement as they reach the traditional age of retirement (as some people are unable to survive on just retirement savings).16

One thing that I strongly believe in, is that supporting a 100-year life is not just about saving and investing with retirement in mind. It is about supporting a fulfilled life – having savings, a home, and a pension are all important – but so is productivity, vitality, and family. The future of your personal finances must be reimagined as the 100-year life looms, but so does your behaviour. This includes shifting your mindset on finances, wealth creation, wealth preservation, and achieving the financial freedom to live your life without limitation. As your life expectancy increases, it is about financing the older version of yourself, not just the retired version.

Living longer does have its benefits. From ancient times, human civilizations have revered long-lived people and finding the solution to eternal life for a reason. With more time available, you can accomplish more; do the things that make you happy, that add meaning to your life, and leave a legacy for yourself and your loved ones. Since there are more productive hours available, you must spend it wisely. Think about it. If you live to 70 years old, you have access to an estimate of 124,800 hours for your entire lifetime.17 Where you spend your time is how you will spend your life.

Now, think of those hours in terms of currency:

- Where do you use them?

- How do you spend them?

- How much is set aside for a diversified life?

- How much is used for risk appetite?

The number of available hours increases by almost 100,000 to 218,000, if you live to be 100 years old.18 Pension funds and investments are not enough to cover these extra living costs, and you will need to diversify your investment portfolios and earn passive income streams. You need to invest in both traditional and alternative assets to build your wealth, in such a way that you do not outlive your assets.

The extra time increases your responsibility to spend it wisely, and you may find yourself asking these questions:

- What will you do with all these extra hours?

- Will you upskill?

- Will you change careers a few times?

- Which stages will you add to your life?

- Will you take a mid-life break to travel?

- Will you take on part-time work?

- Will you rethink the way you invest?

- Will you reimagine the way you create, grow, and protect your wealth?

The problem is marketing focuses on ‘financial well-being’, and as a marketer I sincerely apologise and promise to do better. This buzzword from larger financial institutions has turned the terms ‘financial well-being’ and ‘financial wellness’ into empty phrases that put people off from saving money. The reason marketing jumps straight to the outcome, the ‘have’ potential, is to tap into the emotional part of the brain. I can market a dream and sell it.

The magic trick is that people then focus on instant gratification such as credit, to immediately purchase all the big ticket or luxury items they should save for instead. Think of how relatable these expenses are: from take-out food to fine dining, attending concerts and having the latest name brand apparel, enjoying the features of a new cell phone or car, and even going as far as purchasing expensive homes. The unfortunate result is that financial industries misuse the words ‘financial wellness’ to promote more financial products. Instead of becoming financially literate, and taking control of your finances, you buy into what they are selling (I have also been guilty of this).

The outcome

Our beliefs influence our behaviours and drive us directly to financial freedom. Information that drives financial information and education today tends to go straight to the outcomes, it does not pay attention to behaviours or beliefs.

In my opinion, without looking into the beliefs that shape our behaviours and individual goals, this dream is not sustainable. We need to shift how people think, plan, and act towards wealth creation and preservation; not just package the outcome that saving alone will be the answer to financial freedom.

1 O’Brien, S. (March 2022). ‘Saving for retirement is the top financial priority for just 17% of adults, survey shows ‘. Retrieved from CNBC.

2 O’Brien, S. (March 2022). ‘Saving for retirement is the top financial priority for just 17% of adults, survey shows ‘. Retrieved from CNBC.

3 Updegrave, W. (June 2016). ‘48 years old and nothing saved for retirement’. Retrieved from CNN Money.

4 Updegrave, W. (June 2016). ‘48 years old and nothing saved for retirement’. Retrieved from CNN Money.

5 Doyle, K. (February 2019). ‘55% of Americans think they don’t earn enough money to invest, survey finds’. Retrieved from Yahoo Finance.

6 Bizouati-Kennedy, Y. (May 2021). ‘Americans’ savings drop to lowest point in years’. Retrieved from GoBankingRates.

7 Spector, N. (August 2022). ‘Women still invest less than men — experts say it’s time to ditch the insecurity’. Retrieved from GOBankingRates.

8 Spector, N. (August 2022). ‘Women still invest less than men — experts say it’s time to ditch the insecurity’. Retrieved from GOBankingRates.

9 Staff Writer. (January 2022). ‘Here’s how much money South Africans are saving for retirement’. Retrieved from BusinessTech.

10 Staff Writer. (May 2021). ‘Shock retirement numbers for South Africa‘. Retrieved from BusinessTech.

11 Roser, M., Ortiz-Ospina, E., and Ritchie, H. (October 2019). ‘Life expectancy’. Retrieved from Our World in Data.

12 Gratton, L., and Scott, A. (2018). ’The 100-year life. Living and working in an age of longevity’. Retrieved from The 100-year life.

13 Elkin, K. (January 2019). ’Millennial households are earning more money than ever before — here’s why it may not be enough’. Retrieved from CNBC.

14 Shukla, A. (November 2018). ’Society, governance and the Fourth Industrial Revolution’. Retrieved from Ank Aha.

15 Gratton, L., and Scott, A. (2018). ’The 100-year life. Living and working in an age of longevity’. Retrieved from The 100-year life.

16 Gratton, L., and Scott, A. (2018). ’The 100-year life. Living and working in an age of longevity’. Retrieved from The 100-year life.

17 Gratton, L., and Scott, A. (2018). ’The 100-year life. Living and working in an age of longevity’. Retrieved from The 100-year life.

18 Gratton, L., and Scott, A. (2018). ’The 100-year life. Living and working in an age of longevity’. Retrieved from The 100-year life.