This influx of skilled workers, with an average annual compensation of $100k, is expected to have a substantial impact to the local real-estate market. Furthermore, HQ2 will bring a significant number of non-Amazon job opportunities and indirect investments to the winning city. As an example, it is estimated that over the last seven years, there have been 20 Fortune-500 companies that have opened an R&D facility in Seattle including Apple, Google, Facebook, and Uber. During this time, the “Amazon affect” has generated $38bn of additional investment in Seattle, with every $1 invested by Amazon resulting in $1.40 in the city’s economy.

Amazon’s Real Estate Needs

Amazon has indicated they require a minimum of 500k sq. ft. by 2019, with plans to expand to 8m sq. ft. across 100 acres in the next 10 years. To put this in perspective, Amazon’s current Seattle headquarters is a total of 8.1m sq. ft. and employs 40k workers.

In that same period, home prices in Seattle have jumped by over 83% and rents by over 47% according to Zillow. In the last three years alone, Amazon has gone from occupying 9% of Seattle’s prime office space to 19%. In fact, PwC has named Seattle the top-ranked market in real estate in 2018.

There is no doubt that HQ2 will have a significant impact on the local real-estate economy and will certainly drive massive price increases in both the residential and commercial markets. In fact, some opportunist investors have already been buying up parcels around possible Amazon development zones across a handful of potential HQ2 cities, already driving up prices.

The Amazon “Crisis”

But not everyone agrees that HQ2 is the proverbial golden ticket – unaffordable housing, traffic nightmares, inadequate infrastructure, and increased homelessness are all a common problem in the Seattle area. Furthermore, policy experts have issued a warning to competing cities to not give away too much to attract Amazon, including unsustainable tax breaks or promises they can’t keep. There is even a Change.org petition headed by some of the country’s biggest economists and policy experts urging cities to not bend too far backwards to Amazon.

So, Which City Will Win?

As of January, the competition is down to 20 cities and Amazon is expected to make a final decision sometime in mid-2018. In the meantime, the finalists are going all out to ensure their city is the winner.

The remaining cities include:

Atlanta, Austin, Boston, Chicago, Columbus, Dallas, Denver, Indianapolis, Los Angeles, Miami, Montgomery County (MD), Nashville, Newark, New York, Northern Virginia, Philadelphia, Pittsburgh, Raleigh (NC), Toronto, and Washington DC.

How Can You Take Advantage of the Pre-HQ2 Real Estate Market?

Do your homework and pick a few cities that you think meet Amazon’s requirements, including:

Metropolitan areas with more than one million people

A stable and business-friendly environment

Urban or suburban locations with the potential to attract and retain strong technical talent

Communities that think big and creatively when considering locations and real estate options

Once you’ve narrowed down your list, review the local real-estate market to identify any potential opportunities for investment.

Or, you can log-on to our platform at Wealth Migrate and review our current investment opportunities. With a minimum investment size of only $1000, you can invest in the next HQ2 city before everyone else jumps in.

My top-3 HQ2 predictions? Atlanta, Austin, or Philadelphia.

(Note: As an active investor in the Philadelphia market, I, of course, am cheering for Philly!)

About Wealth Migrate

Wealth Migrate is a global FinTech real estate investment platform that enables people to invest in commercial real estate from as little as $1000 through Collaborative Smart Investing™.

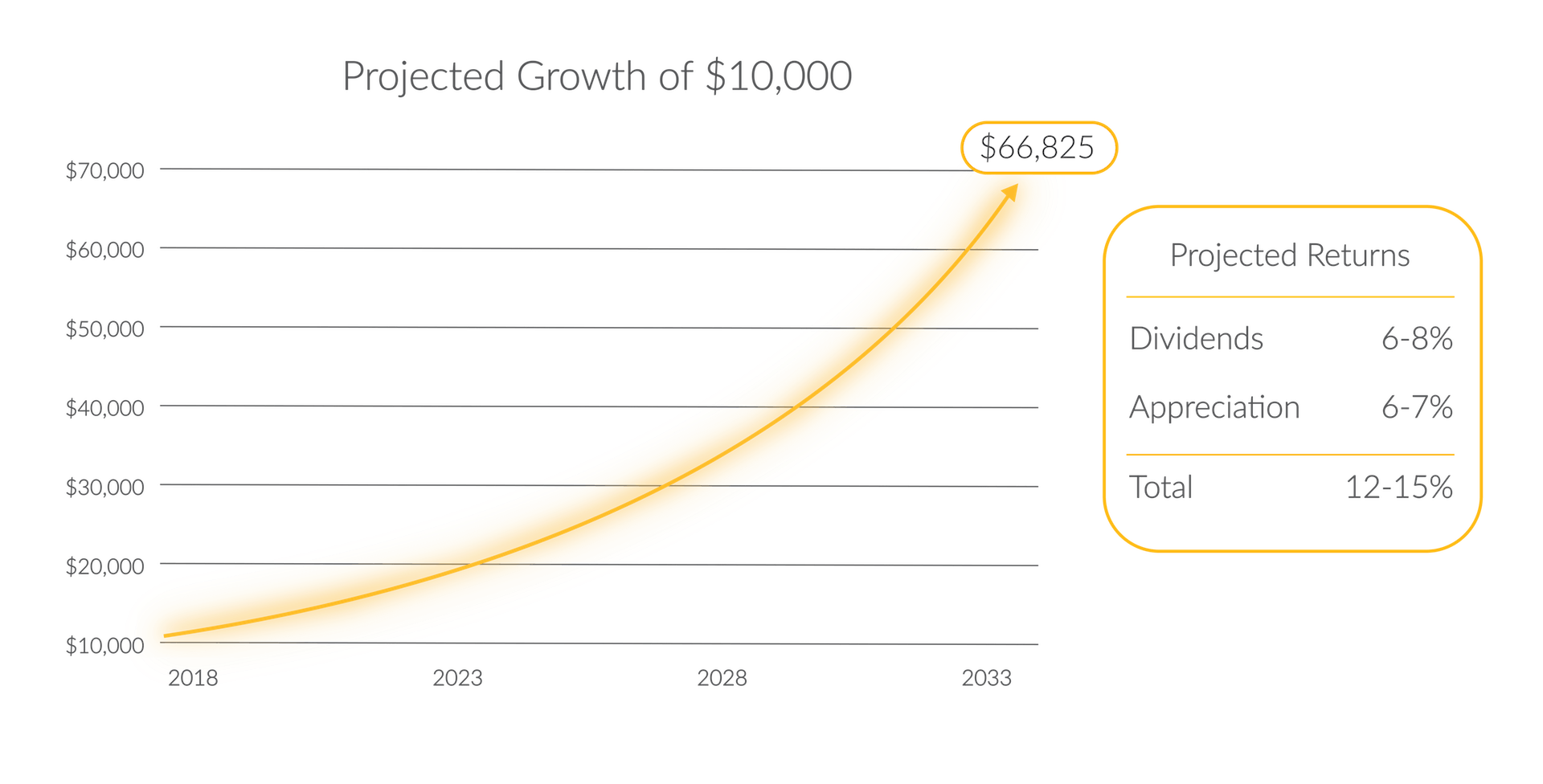

We empower investors to build generational wealth through Collaborative Smart Investing™ by facilitating global real estate investment opportunities that surpass standard investment returns. We ensure that our investors and real estate partners interests are aligned thereby generating higher returns for investors with fewer costs and lower risk in a compliant and safe way.

Wealth Migrate is the only true global real estate platform with members from over 100 countries and offices in the USA, South Africa, Australia, UK, China, and the Middle East.