How To Fund Your Investor Wallet Securely Online

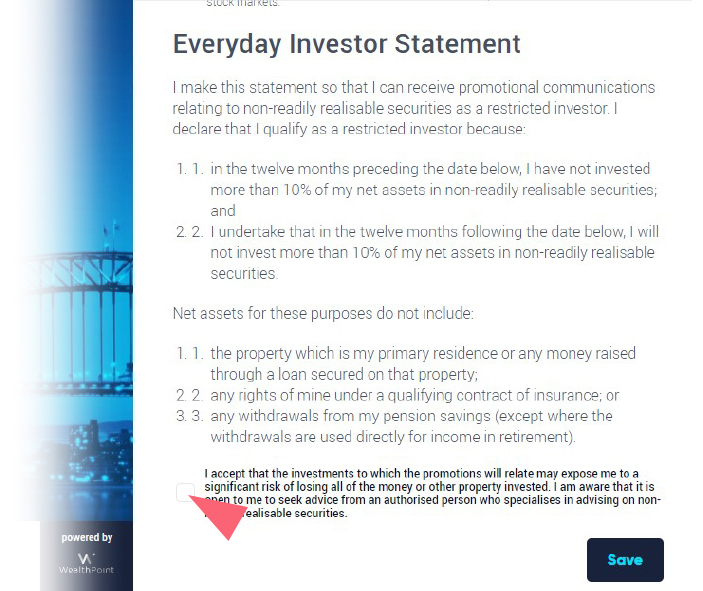

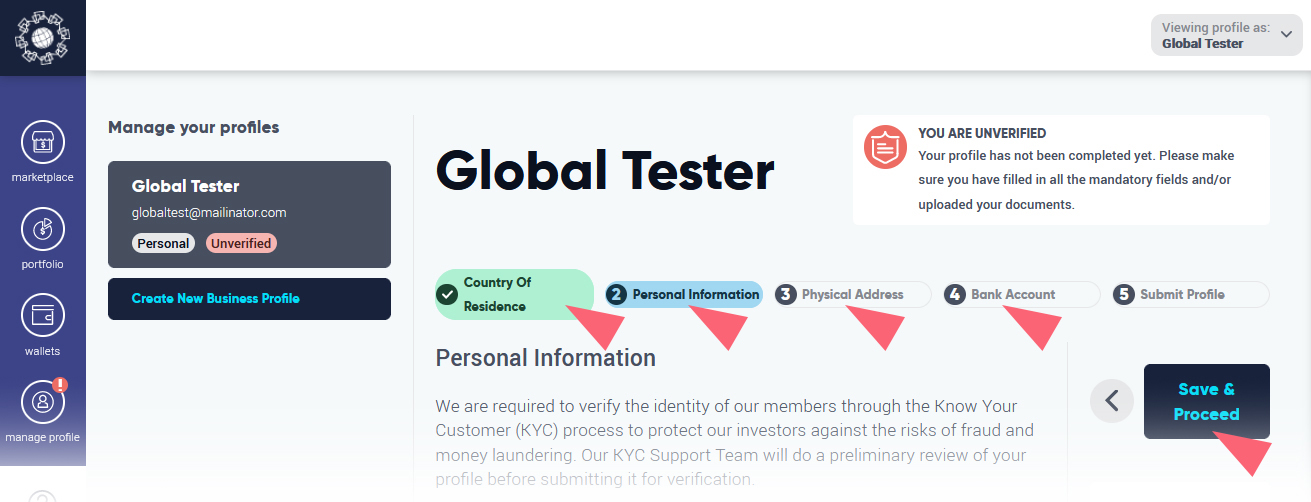

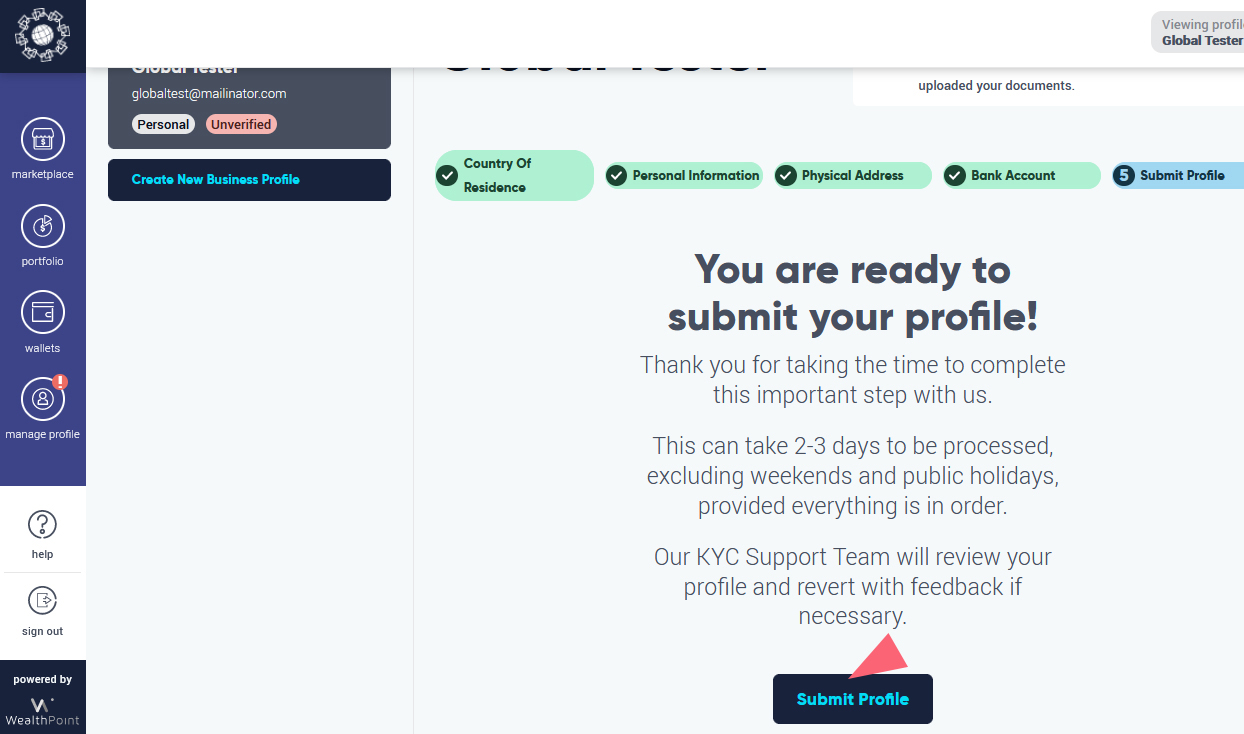

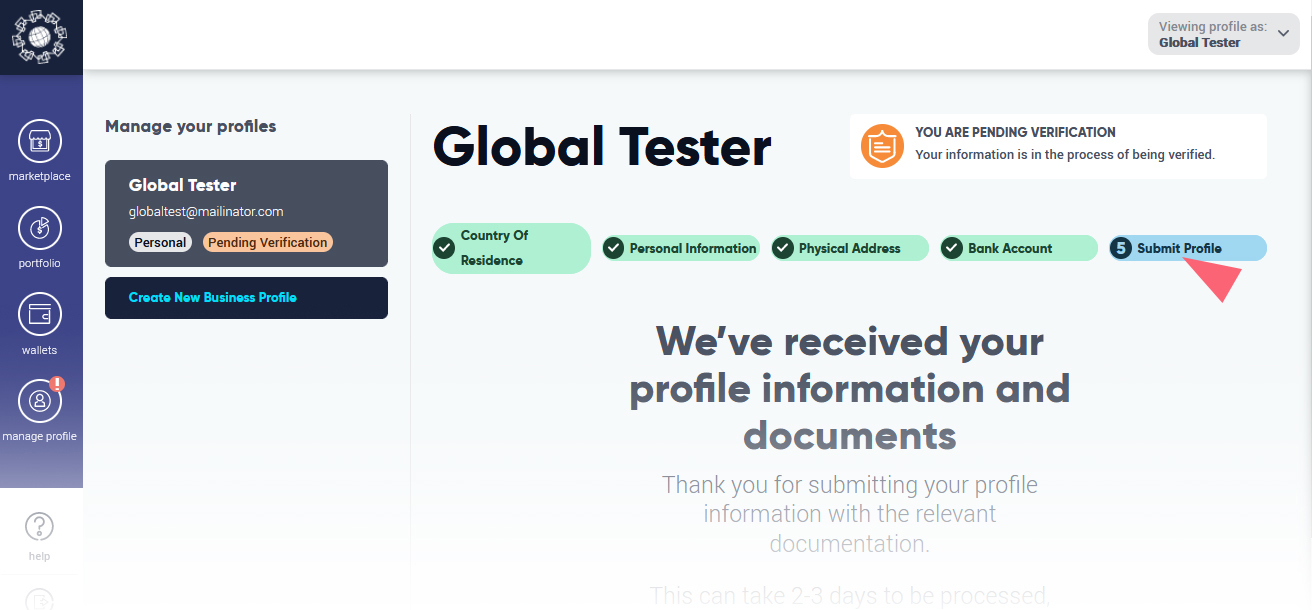

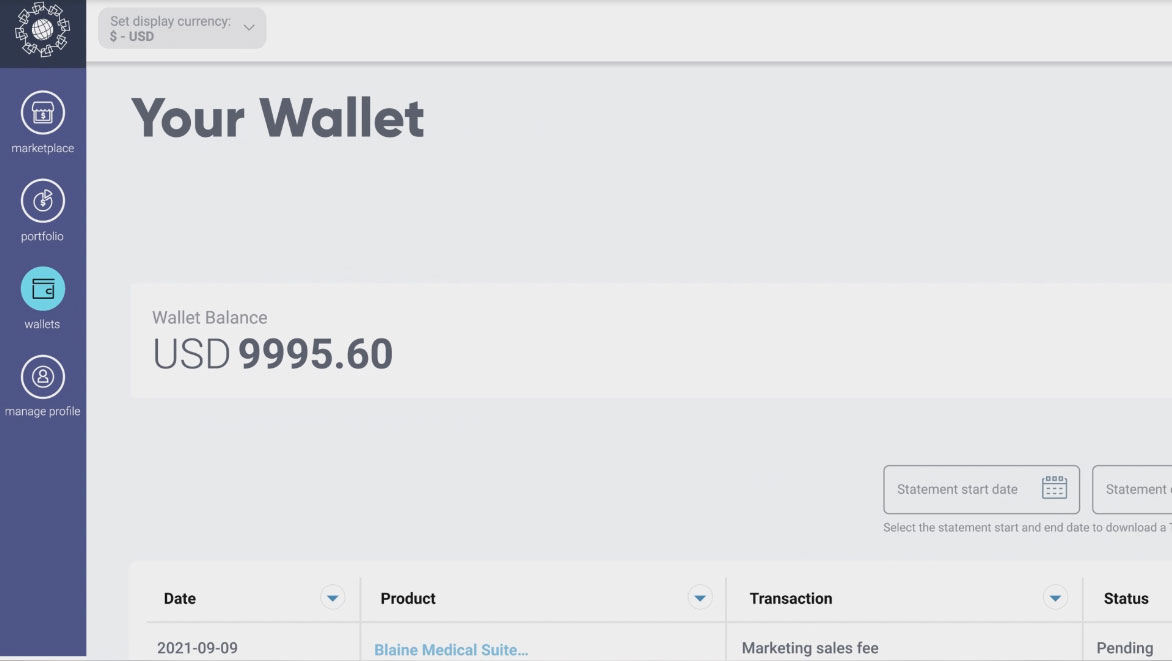

Now that you have completed the Know Your Client (KYC) part of creating an investor account, funding your wallet is the next step to becoming a Wealth Migrate investor. Diversify your portfolio on our FinTech platform with a personal digital wallet.

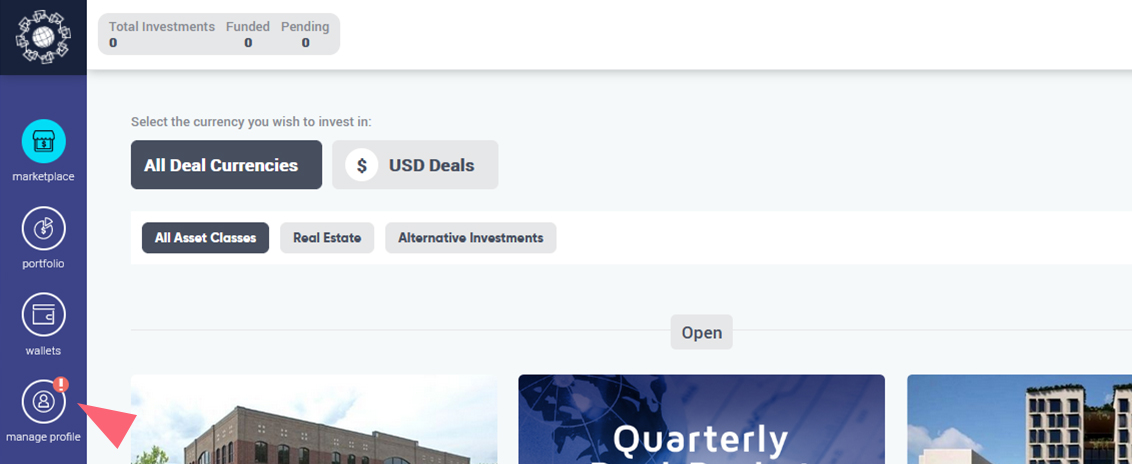

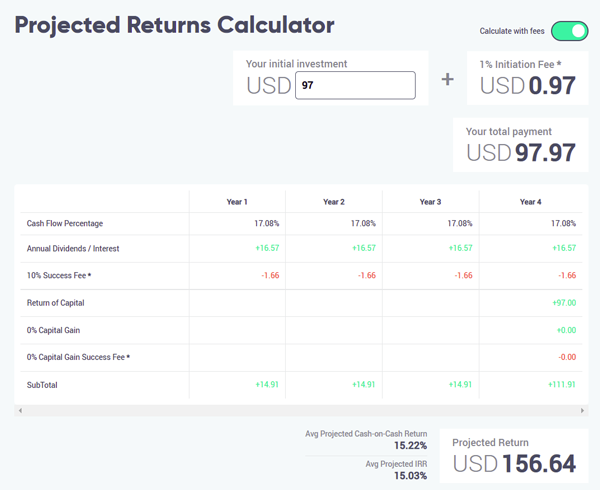

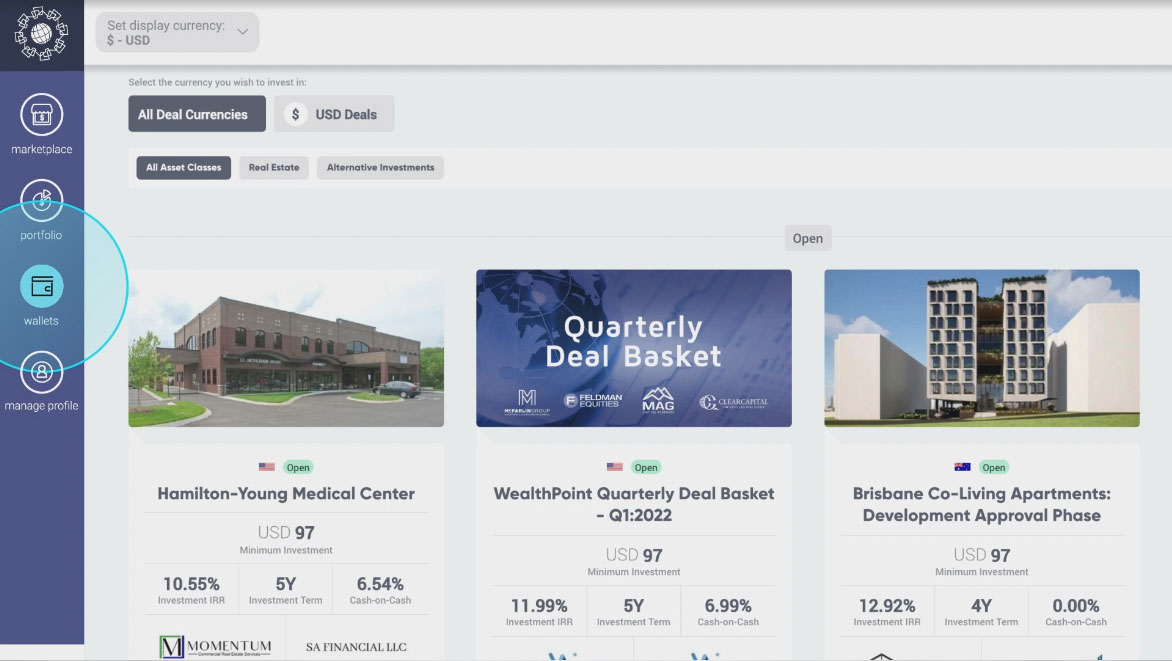

The diverse investment deals available on Wealth Migrate’s marketplace range from as little as $100 (USD) or more, and from time to time we may run exclusive offers where the minimum investment amount is reduced.

As an investor, you can access a complaint and well-regulated platform to invest in a range of diverse institutional-quality real estate or structured note deals. Usually, individual investors lack the access and wealth to invest in such deals, but this digital platform creates an opportunity for a more accessible method of wealth creation.

Our partnership with Lemonway ensures your financial transactions are safe and secure

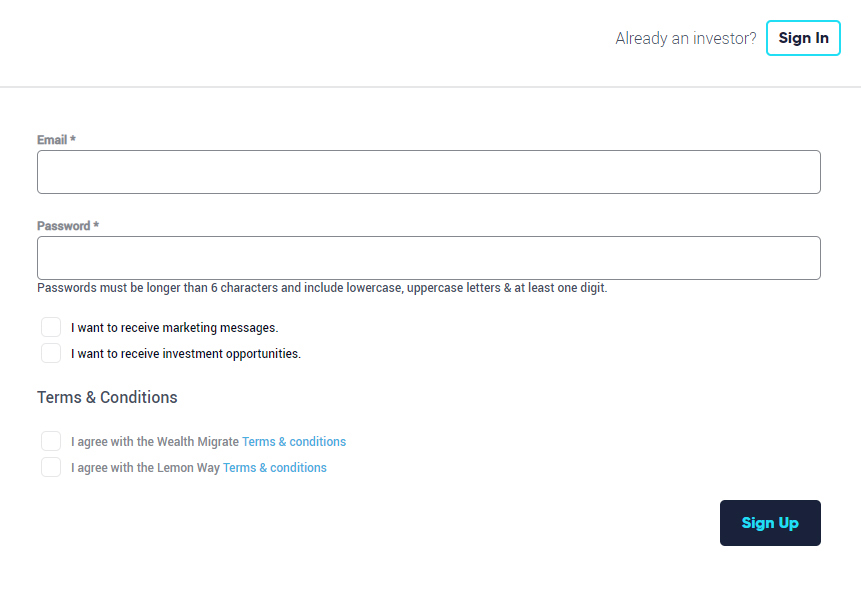

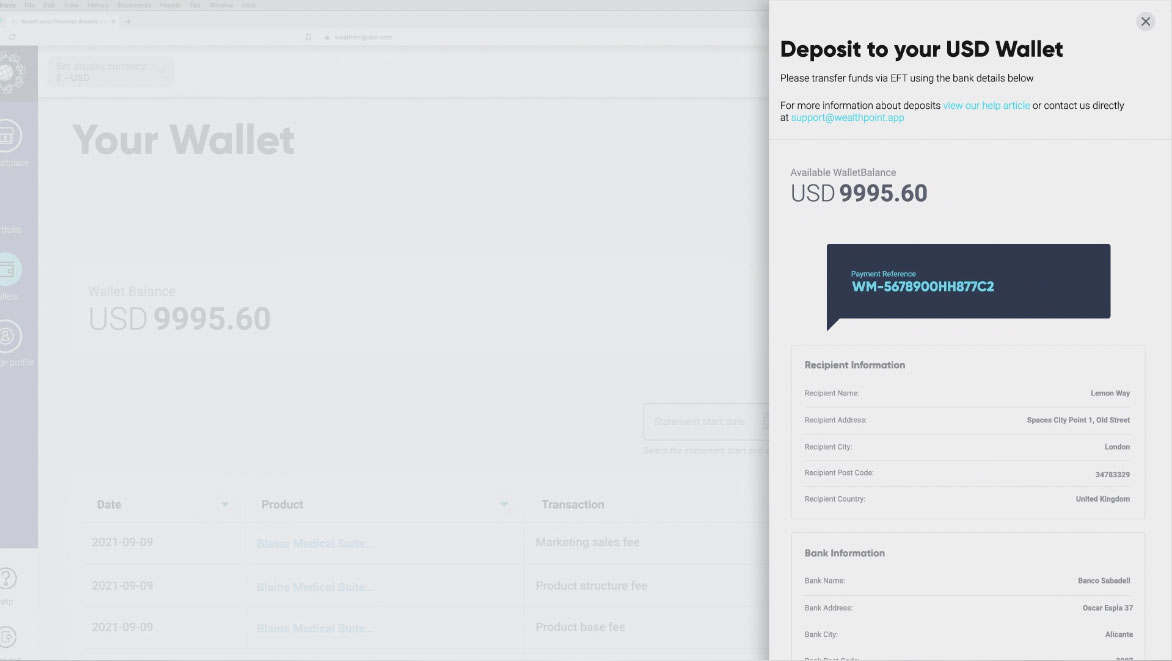

Through our partnership with our European wallet and cash custody provider Lemonway, we provide a digital wallet that is accessible and secure for our you to create and preserve wealth. Lemonway enables us to offer a FinTech platform where you can fund a single transactional wallet and invest in opportunities that meet your personal investment portfolio requirements.

This is what our partnership with Lemonway means for you:

- Lemonway holds a Payment Institution Licence – DSP2 Regulation 2015/2366. This licence is valid in all European countries including the UK. Article 10 details Lemonway’s obligations to comply with client money rules, and Lemonway upholds compliance with CASS and the Financial Conduct Authority’s client money rules.

- The contractual relationship with our partner allows Lemonway to hold our investors’ money (under CASS 6) – this also ensures there is strict control over the movement of funds (under CASS 8).

- Records, accounts, and reconciliations – Lemonway keeps records of all individual investor transactions and balances, this includes additional security measures pertaining to electronic signatures and further internal checks and balances.

- In case a business partner or Lemonway goes insolvent there is support for firms in terms of CASS 7A (client money distribution and transfer) and CASS 11.13 (debt repayments). Where all funds are attributed to individual accounts and Lemonway transfers obligations to one or more run-off management designated firms.

Your personal and financial information and transactions are protected

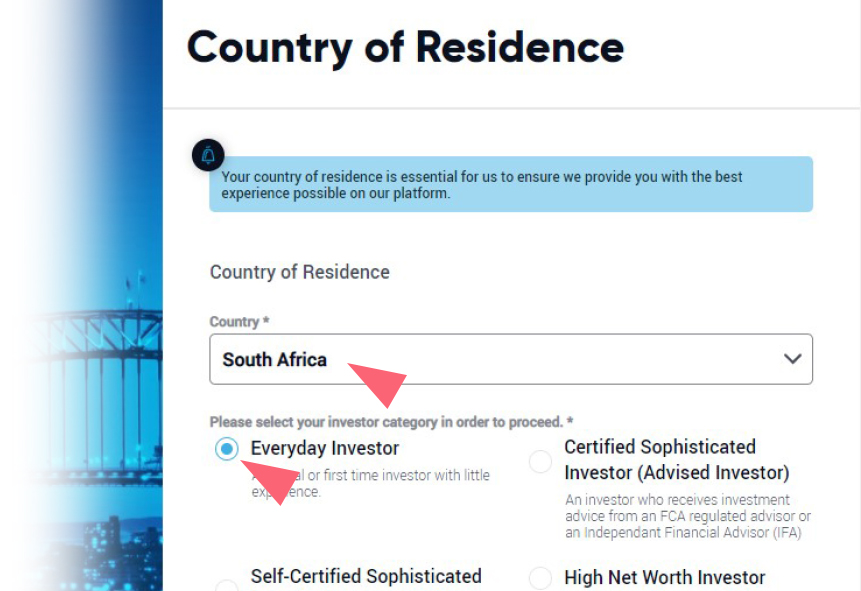

In short, our procedural operations cover two countries for data jurisdiction: South Africa and France. Most of our administrative team resides in South Africa and France is the location of our KYC and wallet service provider.

For South Africa, our team upholds the Protection of Personal Information Act (POPI Act 4 of 2013) as gazetted by the South African Government. In respect of France, as part of the terms and conditions agreed to during the create a personal account process, you consent to having your information shared with Lemonway.

The information you provide is used to verify your identity and create a digital wallet in your name and Lemonway adheres to the General Data Protection Regulation EU 2016/679. If you would like to read more on Lemonway’s data protection policy, click here to access it.

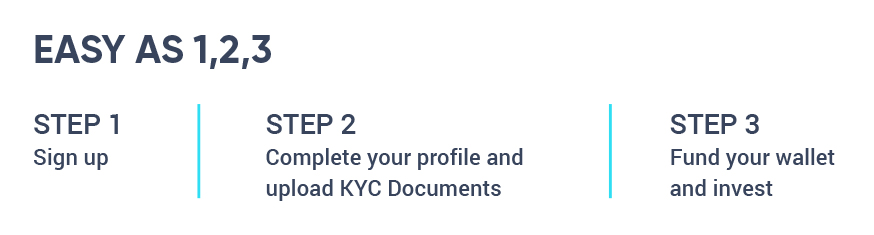

Follow this process to fund your digital wallet

In terms of our business, we have chosen the currency of US Dollars to fund investment deals on Wealth Migrate’s platform. All our deals require you to have US Dollars to invest and that’s why you will need to have a digital wallet.

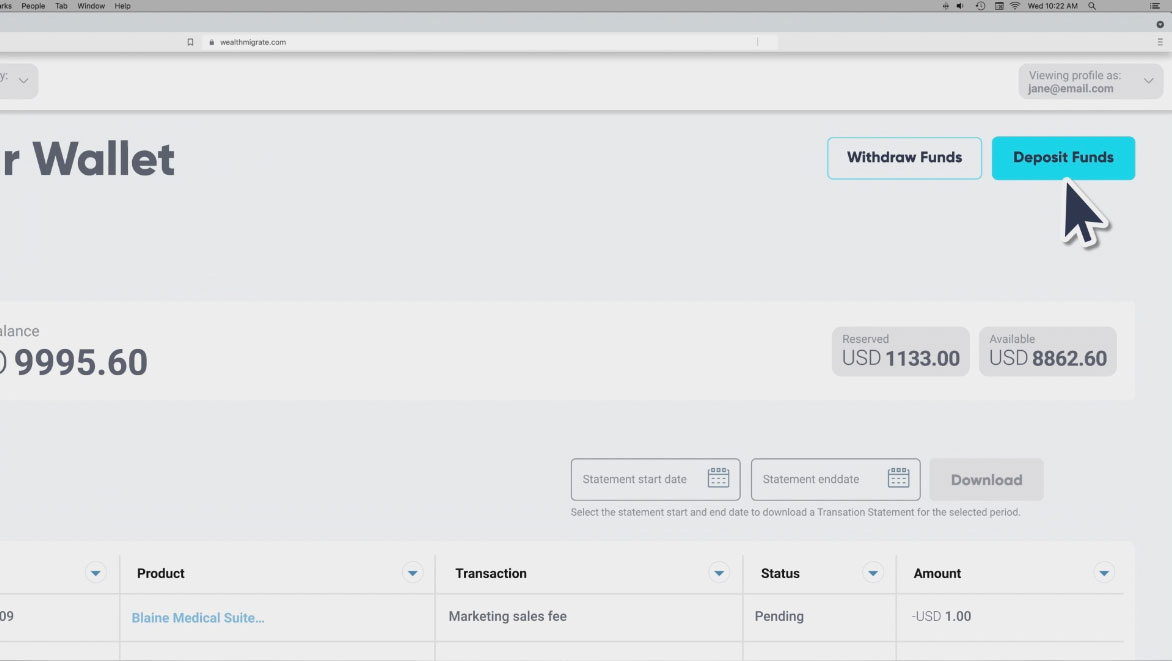

Ensure your wallet has enough funds for your investments by wiring US Dollars to your US currency digital wallet, you can do this by logging into your account, and clicking on the wallet icon. In the wallet section, the term ‘deposit funds’ means that you are completing a wire transaction to ensure you have US Dollars in your wallet. Unfortunately, you can’t go to your bank or to an ATM to do this step, as this is an overseas financial transaction and requires a wire transfer.

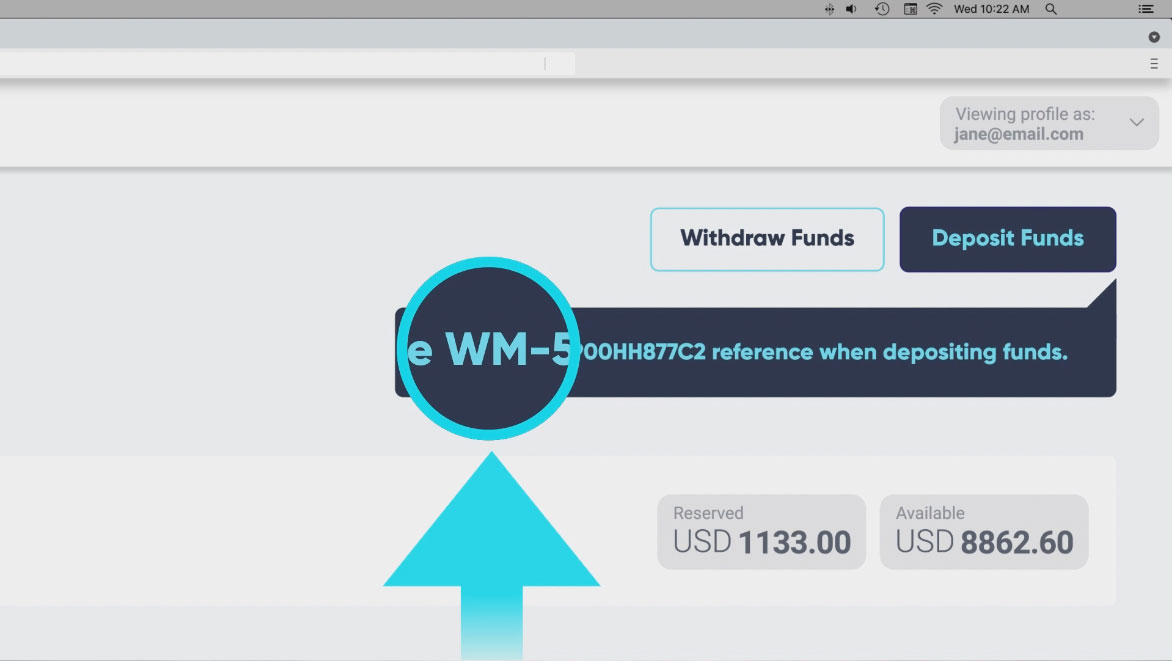

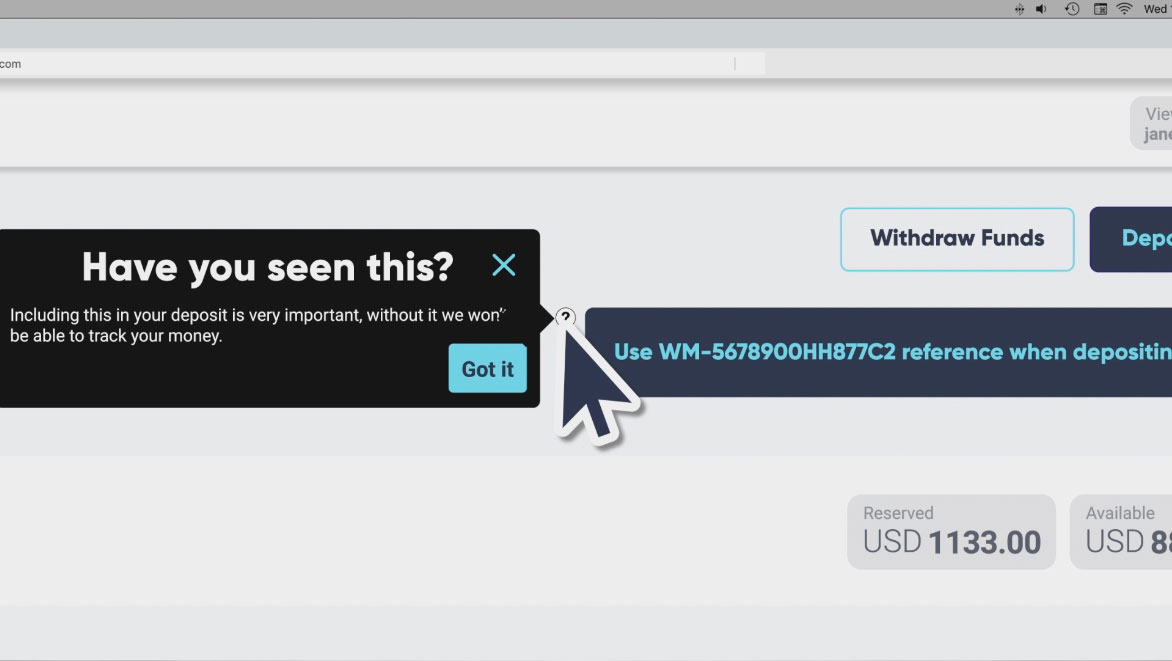

To fund your digital wallet, use your unique payment reference number starting with WM – this shows Lemonway this is from a Wealth Migrate client to ensure the payment goes through. The unique payment reference number will ensure that there is no misallocation of funds to your wallet.

If there’s an investment deal that you want to invest in before it closes, you will need to fund your wallet in advance. It’s important to note that there is a wait time of three to five business days to receive approval from Lemonway, only after that period will the US Dollars from the wire transfer reflect in your online wallet.

We’ve also made some visual guides available as a downloadable PDF or video to help you with this process. Download our thorough step-by-step guide here for an in-depth overview of the KYC process or view our quick “How to fund your wallet” tutorial video here.

Explore the investment deals available on Wealth Migrate’s Fintech platform and use these visual tutorials as a guide on your wealth creation journey – click here to learn how to invest, and learn to understand and interpret your investment portfolio, here.

How To Fund Your Investor Wallet Securely Online Read More »