Ukraine Conflict: Investors should move their money to safe bets

by Scott Picken, Founder and CEO of Wealth Migrate

The conflict in Ukraine has impacted all industries and, in turn, global trade and investment. Clashes such as the Russian capture of the Zaporizhia nuclear power station have had ripple effects on the world’s stock markets, with the FTSE 100 dropping by over 250 points in a single day – the biggest dip since March 2020. The turmoil has also seen the Dow Jones falling by 11% in the year to date, the S&P500 by 13.4% and the Nasdaq by 19%. With there being no end in sight to the war, it’s easy to see why investors are concerned. This is not to mention the impact it is now having on inflation, with America experiencing a 40-year inflation high in May 2022, causing further volatility in the stock market. However, it is vital that they don’t get distracted by the noise when it comes to mitigating the impact of volatility.

Markets will always be affected by current affairs, with recent events including South African prime interest rates climbing above 25% in the late-1990s; September 11; the dot com boom and bust; the global financial crisis, Brexit, and now, the Ukraine war. In turbulent times, there are three strategies investors must adopt:

Look to the long-term

What disruptive events of the past reveal is that markets move in cycles and so too do industries, assets, countries, and cities. In times like these, investors tend to struggle with analysis paralysis or take money out of the market, buying high and selling low. But investors must consider long-term cycles and trends when making decisions. What might happen in the next month, the next three months or even the next year, is irrelevant. Rather, think about the long term – the next five, 10, 20 or even 30-year cycles – to maximise that investment.

Opt for safe haven investments

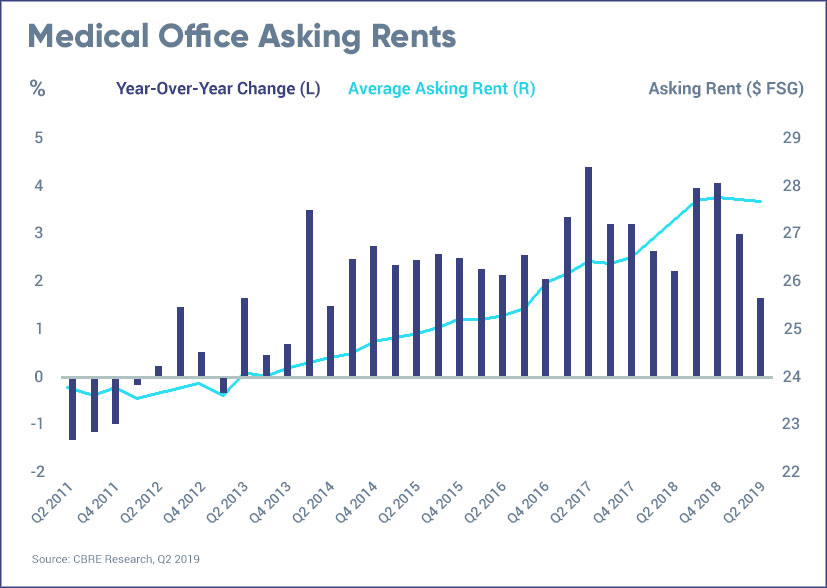

When faced with uncertainty in global world economies, savvy investors make a flight towards safety by diverting capital into assets like property and gold which are safe and predictable. These assets are expected to retain or increase in value during times of market turbulence. The current crisis, for instance, has very little to no direct bearing on real estate portfolios. That said, implications of the conflict are indirect and based on broader macroeconomic impacts such as interest rate hikes. As these tend to fluctuate, again investors will need to maintain a long-term view.

Assets like property are also a hedge against inflation – another side effect of the war. This is because over time, property values tend to remain on a steady, upward trajectory and rent/income or yields are often pegged to inflation.

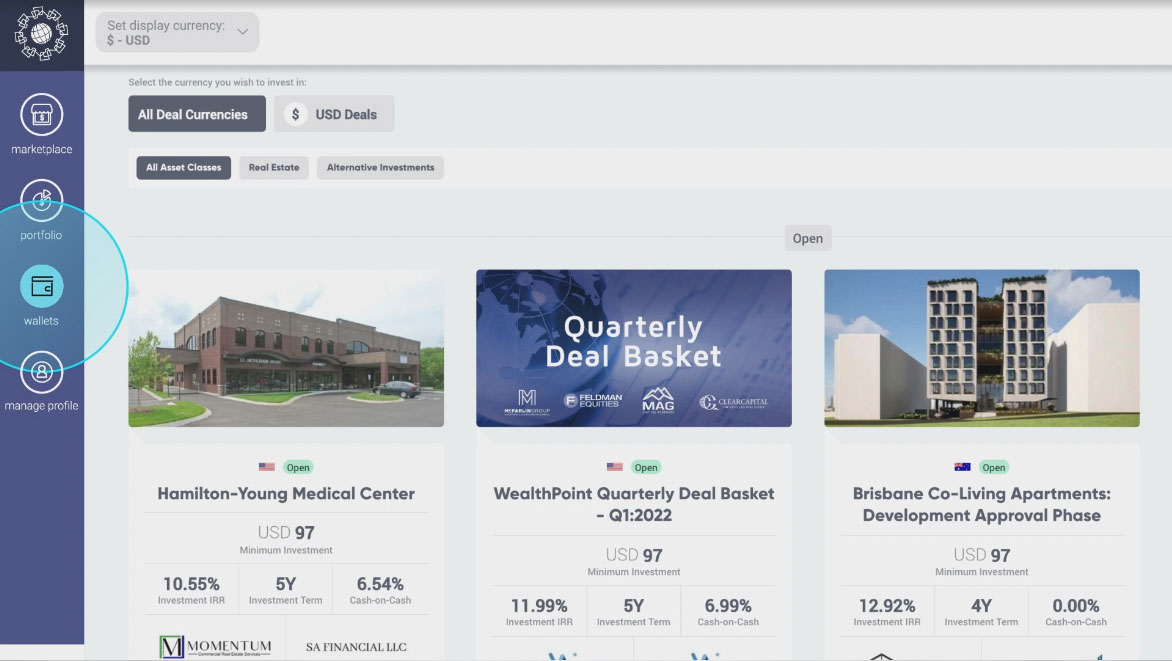

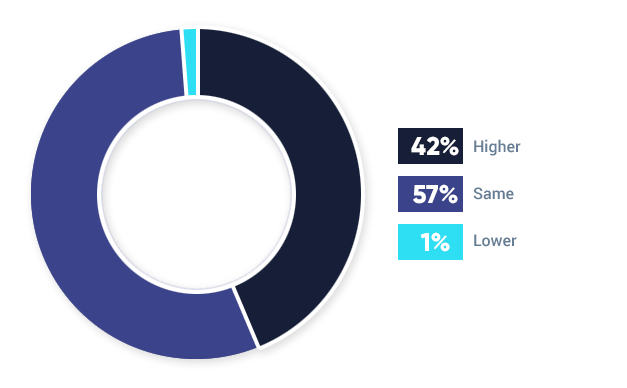

Moreover, a predictable income has been proven to be one of the best strategies for riding out uncertainty. Investors should opt for assets that can help them earn this – another reason why property is a preferred asset. For instance, regardless of the state of the market, people will always need places to live, buildings where they can receive medical treatment or logistic centres to service e-commerce.

Diversify

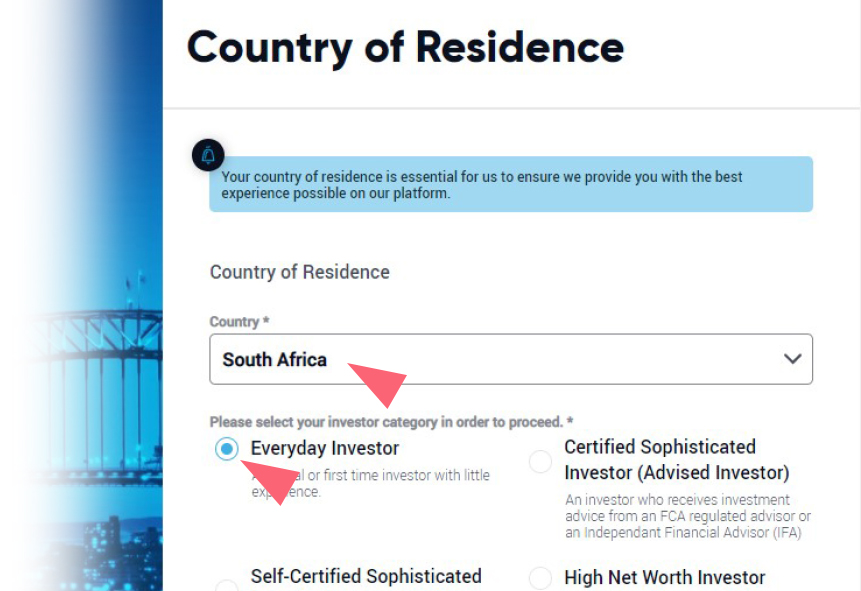

Diversification is crucial for building a portfolio that is resilient in unexpected conditions and so investors should diversify their investments across countries, currencies, and assets. US billionaire and investor Ray Dalio says investors should have 15 quality investments that are not tied together, and as long as they do that, they will reduce their risk by 80%. Plus, they’ll increase their risk return ratio by a factor of five. What this means is a very resilient investment strategy.

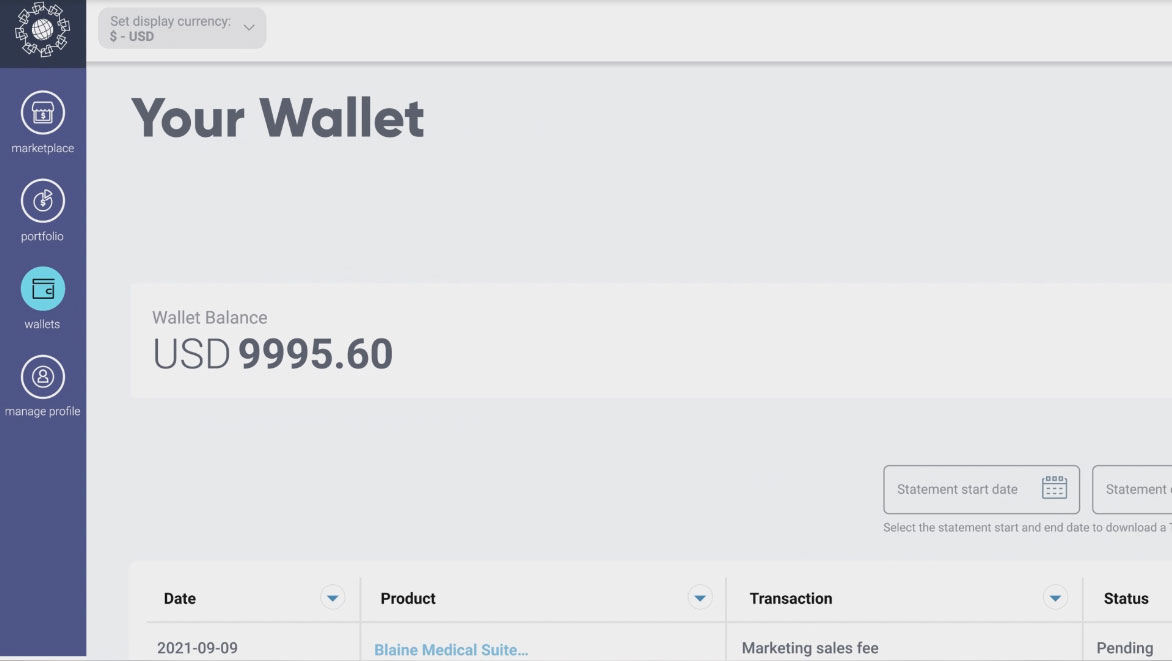

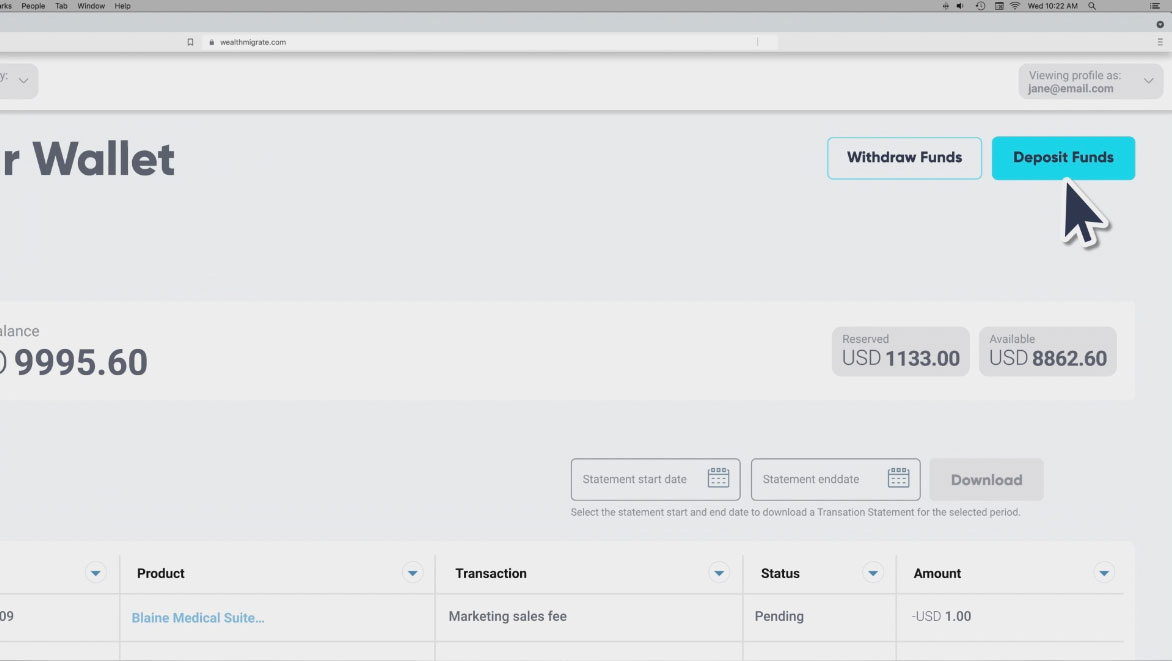

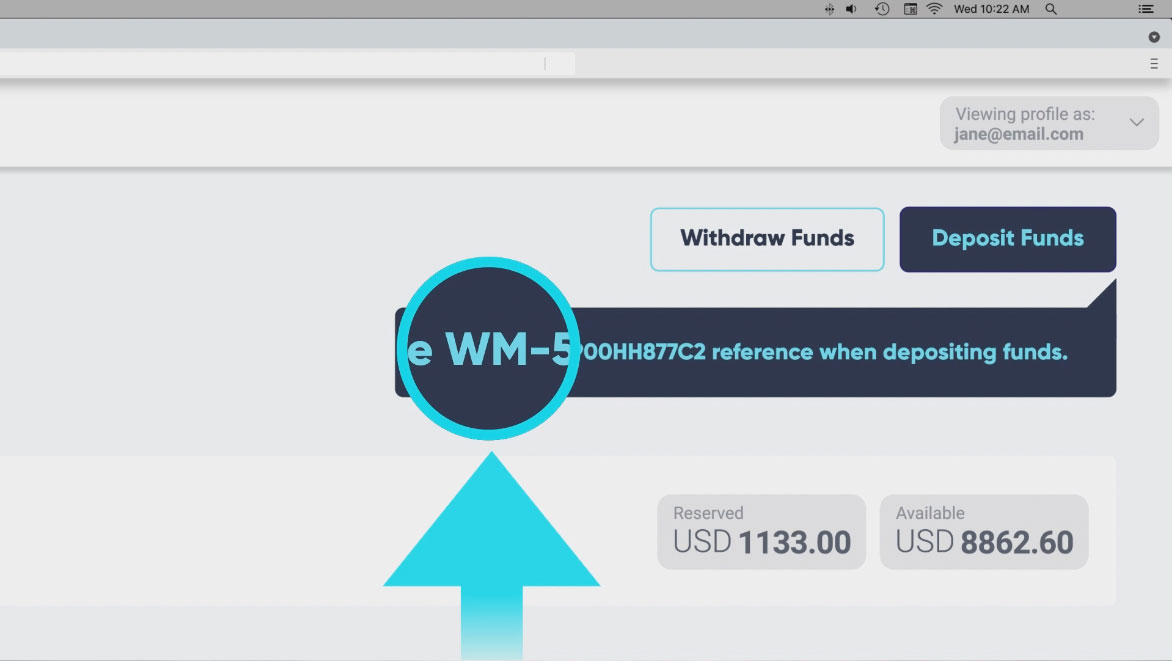

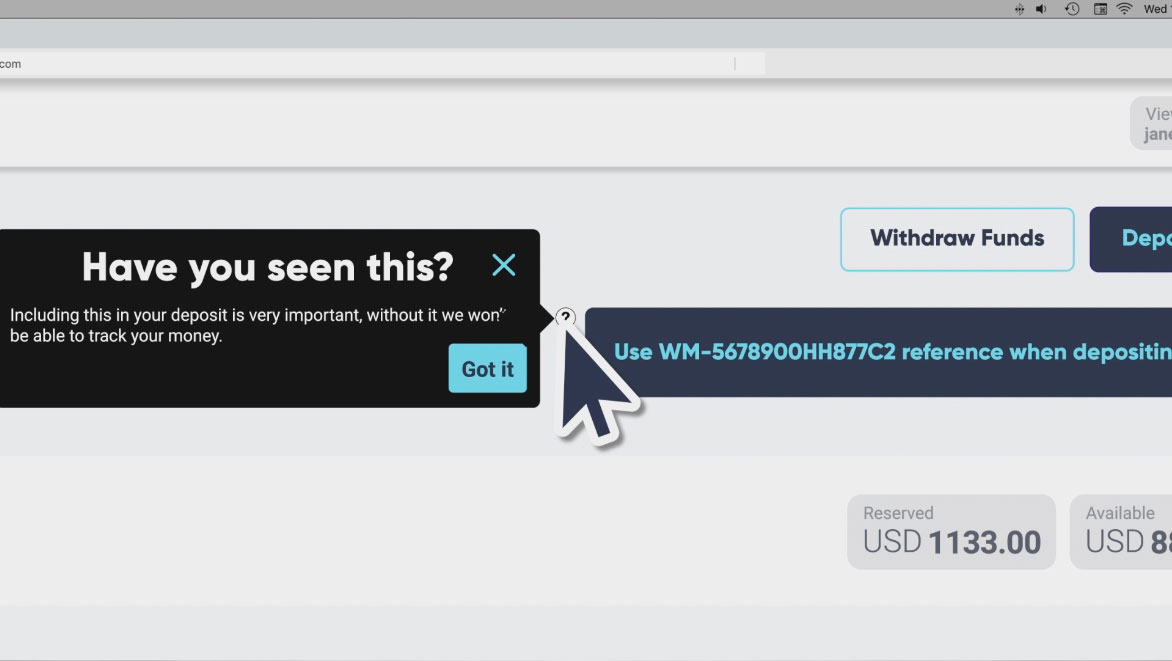

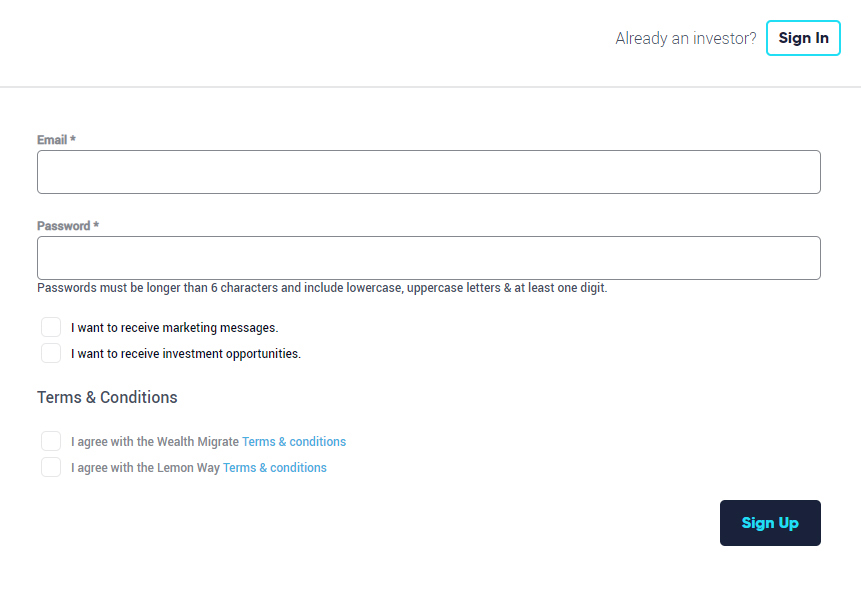

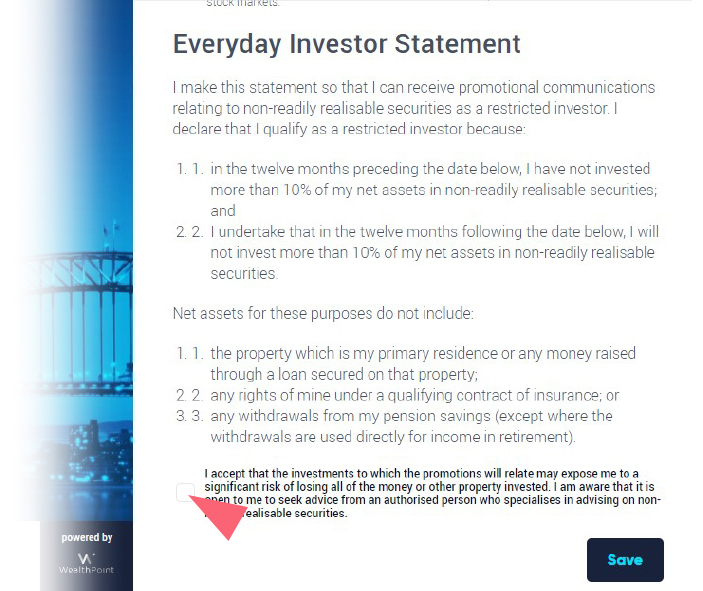

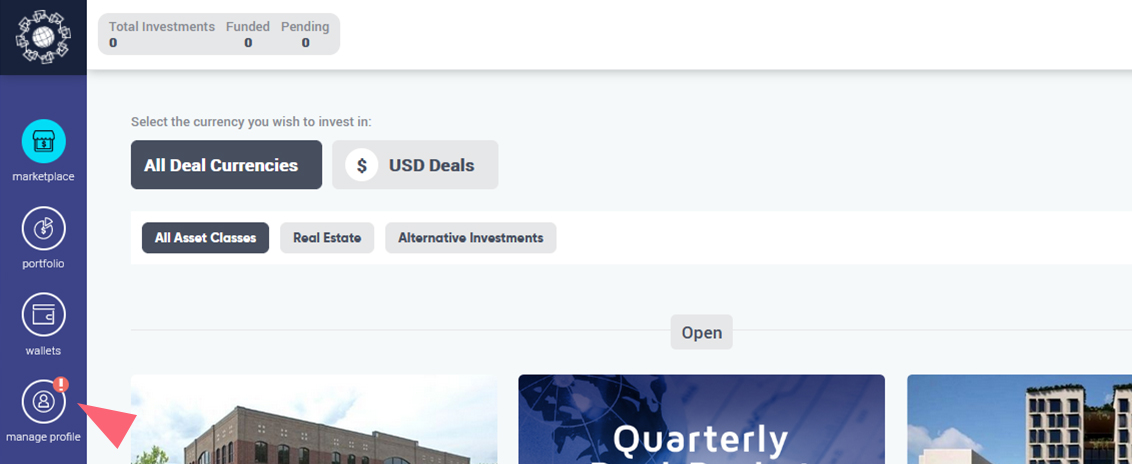

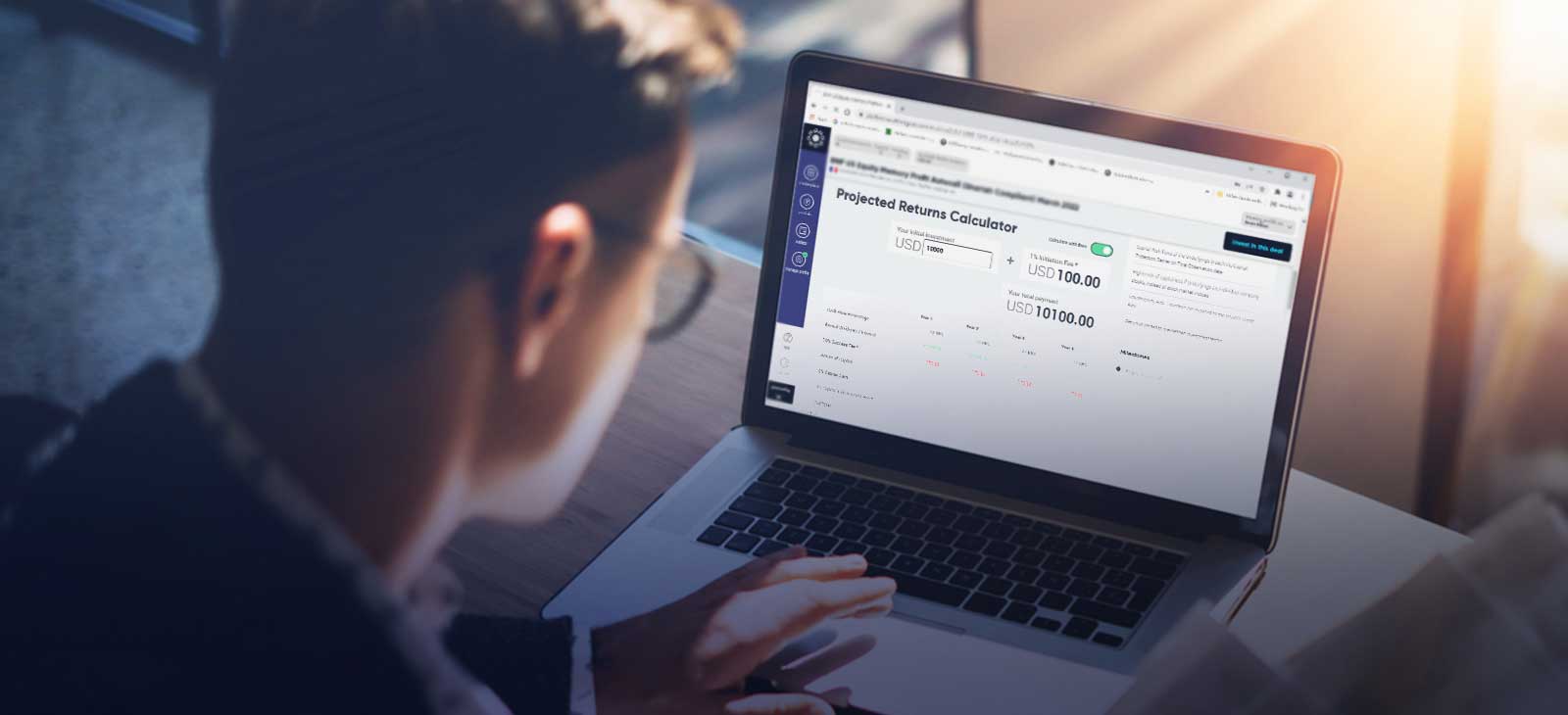

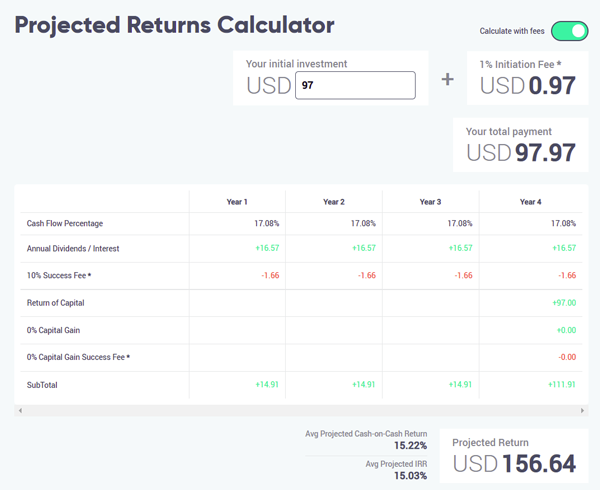

Technology is enabling people to diversify their portfolios more easily. Previously, investors were stuck investing in one country, in one currency and one asset. Now, with $100, ordinary South Africans can invest in 10 different deals, in 10 different assets, in 10 different countries and in many different currencies.

Uncertainty represents an enormous opportunity for investors. Investing in diversified, sustainable assets for the long term can not only help them weather any storm regardless of whether there’s another war, global financial crisis, rising inflation cycle or crypto boom and bust, but also profit once calmer waters return.

For more information, go to https://wealthmigrate.com

About Wealth Migrate

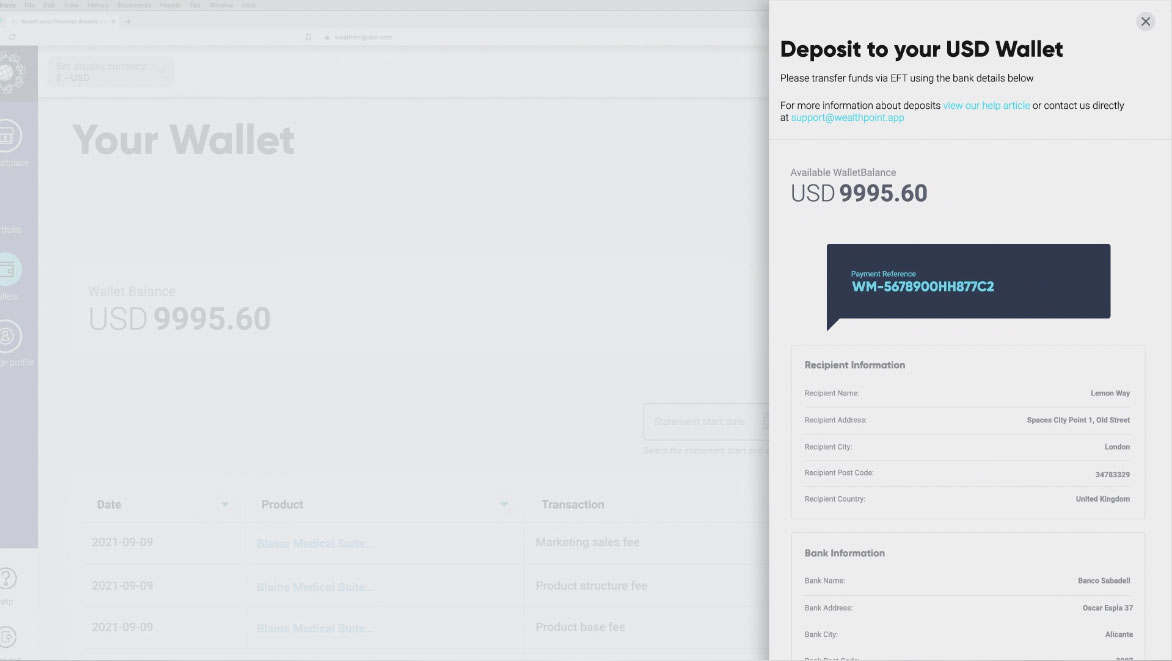

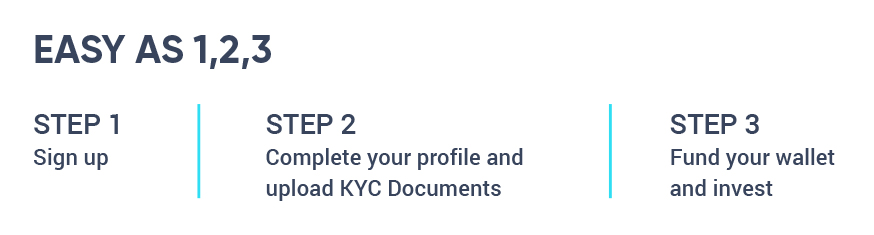

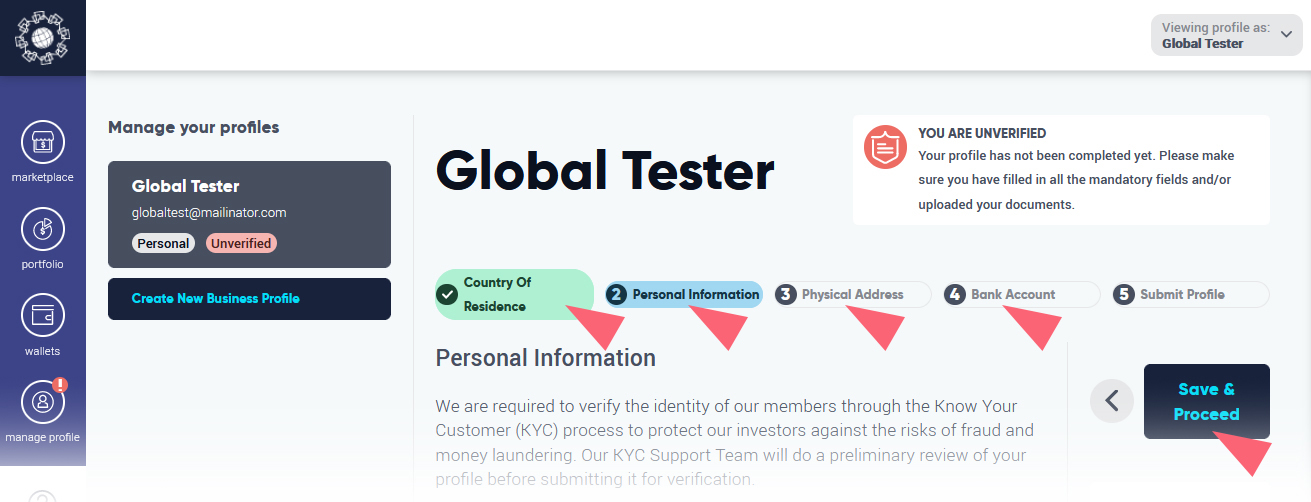

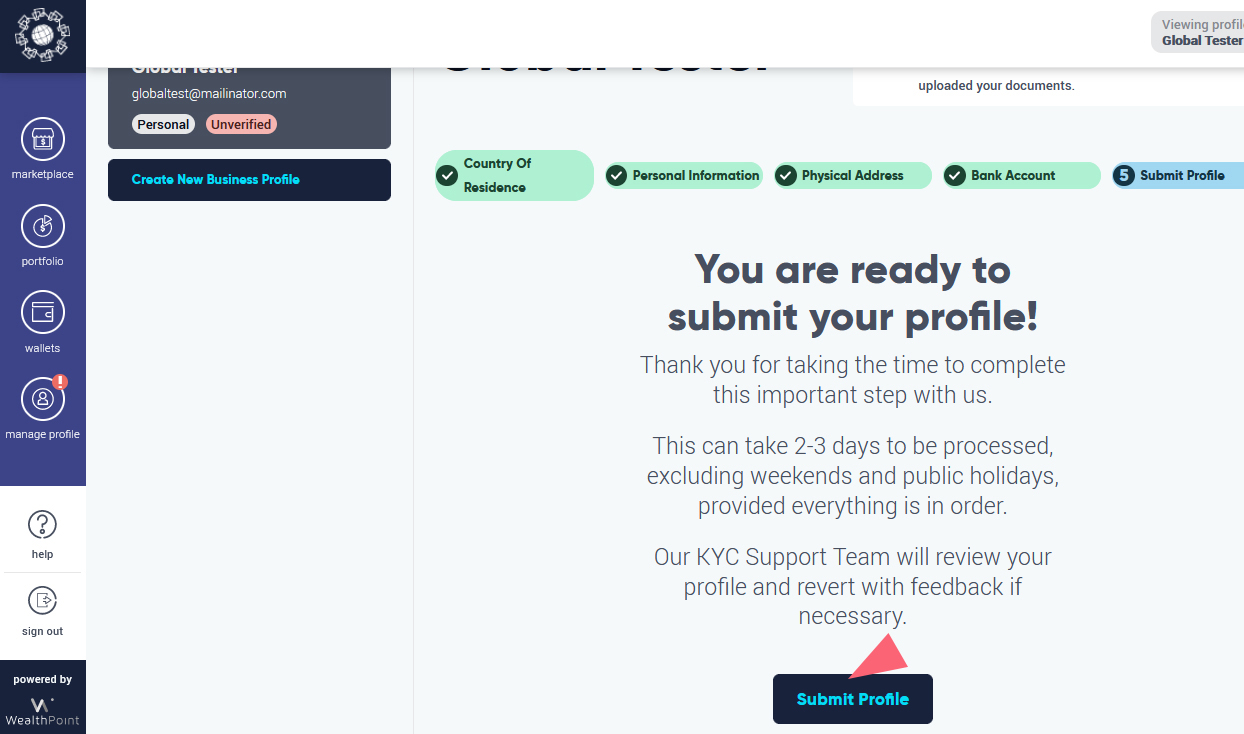

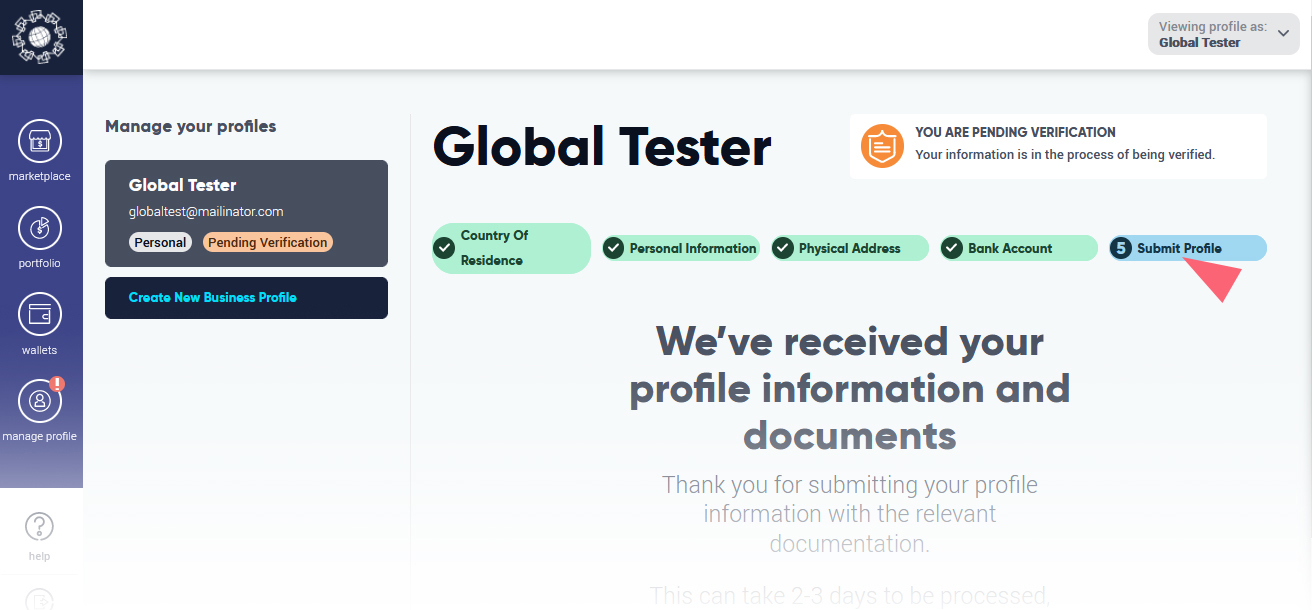

Established in 2010, Wealth Migrate is a leading FinTech real estate investment platform that helps the 99% invest like the top 1% to create more financial freedom in their lives. In so doing, the company is closing the wealth gap, brick by brick. Wealth Migrate’s mission is to put the power of smart investing in everyone’s pockets by providing people with a safe and easy way of not only investing in residential and commercial real estate markets, and alternative assets globally, but also by diversifying their investment on one platform. This is achieved through the use of technology and crowdfunding. They have facilitated over $1,2bn in deals on 5 continents and with members in 171 countries.

For more information, or to invest, go to https://wealthmigrate.com.

Ukraine Conflict: Investors should move their money to safe bets Read More »