Co-living: an emerging asset class for investors

Find out what’s driving the growth of co-living assets

While co-living may be an emerging asset class for investors, factors such as high population growth drive the demand for affordable housing solutions. Purchasing a residence may be an expense that is out of reach for a student, a young professional, or a growing family. It’s becoming more common to rent a living space with communal spaces – especially in global areas where there’s a high need for housing – and the rentals of homes or apartments are more cost-effective.

This is where purpose-built-co-living (co-living) is rising in popularity as it’s a “community living model where residents share communal spaces and services for a higher quality of life”.1Population growth and housing affordability are inextricably linked. In our partnership with BNTO (formerly known as Six C Pty Ltd), this was brought to light in a focused webinar on co-living assets; BNTO is a co-living development and operating company based in Australia.

Global population growth is driving the demand for housing

Below are some interesting statistics on population growth over 20 years in nine major cities worldwide that have led to the rising demand for housing:2

This exponential population growth can be seen in comparison to the forecast statistics that the World Economic Forum published in 2016,3 which predicted the growth of the world’s 10 largest cities by 2030

Housing prices and income are a worldwide concern

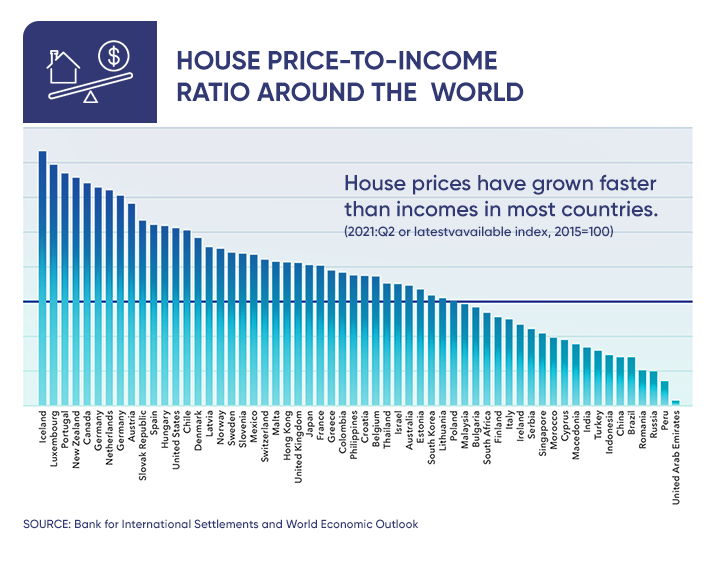

As such, there is a huge demand for housing with high population growth and a supply shortage. Part of the reason affecting the shortage is that housing prices globally have outpaced incomes in most countries. The International Monetary Fund (IMF) has a global housing watch tracker that looks at developments in housing markets and provides current information and metrics to assess this.

The IMF released information in June 2021 detailing this discrepancy between housing prices and incomes. This is concerning as it proves that housing prices worldwide are becoming more expensive over time; in fact, about 50% of earth’s population is unable to afford to buy a home.4 To find a place to live, more people are turning to the rental market to meet these housing needs.

The shift from a buy-to-own mindset to a buy-to-rent mindset is gaining momentum. Housing costs and population growth are promoting different ideas on residential living spaces and bringing it to the forefront. The emergence of the co-living housing market can’t be underestimated, as the concept of shared housing and informal ‘paying guest’ accommodation has combined to formalise a new way of living.5

Although co-living is only one segment of the rental housing market, it’s becoming a vital part of it due to the flexibility of its short– and long– term leases and its affordability. Co-living also brings together the benefits of community, convenience, cost savings and comfort.

Evolution of co-living

Co-living contributes to the “sharing economy” where radical changes in consumer behaviour have overturned traditional business models such as Airbnb and Uber.6 It’s also one of the fastest-growing property sectors globally with over 3.4 million branded rooms in 2020.7 This amounted to a value of $3.75 billion (USD) in 2019.8

While co-living has a strong history with co-housing, house-sharing, and purpose-built-co-living – to fully understand these concepts, it’s important to briefly examine its origins.

The history of co-living as an asset class9

1960s:10

The idea of co-housing began in Denmark in 1964, when Danish architect Jan Gudmand-Hoyer started a discussion group among friends about forming a more supportive living environment. A plan was drafted to build 12 terraced houses around a common house and swimming pool on the outskirts of Copenhagen. Although this plan was approved by city officials, it was opposed by neighbours and none of the co-housing buildings were constructed.

After Gudmand-Hoyer authored an article that was published in the national newspaper in 1968, there was widespread support for the idea from over 100 families. It was after this period that co-housing became more definitive with a few housing collectives sprouting up in like-minded communities around Copenhagen.

1970–1980:

From this period co-housing began to become more common in Denmark, Sweden and Norway with the idea of living in a community to save on living costs. Co-housing provides the appeal of private living quarters and common community areas for dining and activities, and shared responsibilities by residents such as childcare, cooking, and cleaning. Co-housing was mainly targeted at families with small homes sharing services and communal spaces.

1990–2000:

With communal living spaces on the rise, co-housing started gaining popularity and spread to more of the Netherlands and Germany. This gave birth to house sharing; this is more family orientated towards generations of families staying together to save on costs and benefit from communal ties. Flat sharing is now more common, where a group of people or a couple agrees to benefit from pooling resources together and split the costs of maintaining an apartment.

2010–2020:

Communal living has now developed to offer purpose-built co-living, where this style of living seems preferable for individuals or couples. This concept has now gained influence in China, India, and the United States. From 2020 onwards, there’s been a worldwide move to how society plans urbanisation and city infrastructure and development. As rapid population growth and high prices for housing cause housing shortages, larger issues have come into play from scarcity of resources to sustainable living concerns, safety, and a greater focus on saving on living costs.

Investing in co-living assets

The increasing popularity and future demand for flexible accommodations such as co-living environments are expected to continue. This is integral to society’s changing needs for geographic mobility in remote work or a hybrid of working from home and going into the office. Co-living investments present strong returns for investors.11

Although the initial project cost is higher, this yields a higher rental income than multi-family real estate assets, assuming that the exit cap rate is the same. With purpose-built-co-living, a whole building can be made for multiple rooms for let with communal spaces in-between. Co-living may be a more affordable option for residents. The lease often offers a fully-furnished living space and includes all amenities such as Wi-Fi, water, and electricity.

The co-living property is suitable for shared living accommodations with many tenants, this increases rental returns, and makes it a profitable venture for investors looking for higher returns. Co-living property assets may also offer a passive income with regular cashflows to investors if it is an income-orientated investment.12

One of the reasons why passive income investments are popular is that investors can earn money with minimal effort. Once the money is invested in the deal, the investment will carry on over its pre-determined term. If it is an income-orientated investment, this can result in monthly or quarterly payments to the investor. This asset class offers investors a convenient option to diversify investment portfolios within real estate by offering different asset types.

Co-living as a housing option for the future

For residents that desire affordable housing and a higher quality of life while prioritising shared social living experiences, co-living is a promising solution. Purpose-built-co-living offers a tenant a sufficient mix of spaces that cater to privacy or socialising depending on individual preferences. This mix of privacy and exclusivity caters to high-density populations, especially where rapid population growth and housing supply are limited.

As part of an ongoing educational series, our next article will reveal the benefits of investing in co-living assets with a real example. It will also delve into the growing appeal of co-living and its role in residential real estate.

As part of an ongoing educational series, our next article will reveal the benefits of investing in co-living assets with a real example. It will also delve into the growing appeal of co-living and its role in residential real estate.

Find more Wealth Migrate content here:

View our focused webinar on investing in co-living, where our team and deal sponsors analyse the strong demand for this asset class.

Read our investment articles and listen to the podcasts. We cover the topics of diversification, structured notes, and purpose-built-co-living, click here for the full list on Wealth Migrate archives – BizNews.

1 Wealth Migrate. (March 2022). ‘Property 5.0: what is co-living and why there is strong demand for this asset class?’. Retrieved from YouTube.

2 Wealth Migrate. (March 2022). ‘Property 5.0: what is co-living and why there is strong demand for this asset class?’. Retrieved from YouTube.

3 Myers, J. (October 2016). ‘The world’s 10 largest cities by 2030’. Retrieved from World Economic Forum.

4 Wealth Migrate. (March 2022). ‘Property 5.0: what is co-living and why there is strong demand for this asset class?’. Retrieved from YouTube.

5 Kumar, A., and Hatti, C. (December 2019). ‘Global Coliving Report 2019: living, together’. Retrieved from Housemonk.

6 Osztovits, A., Nagy., B., and Koszegi, A. et al. (2015). ‘Sharing or paring? Growth of the sharing economy’. Retrieved from PwC.

7 Wealth Migrate. (March 2022). ‘Property 5.0: what is co-living and why there is strong demand for this asset class?’. Retrieved from YouTube

8 Wealth Migrate. (March 2022). ‘Property 5.0: what is co-living and why there is strong demand for this asset class?’. Retrieved from YouTube.

9 Wealth Migrate. (March 2022). ‘Property 5.0: what is co-living and why there is strong demand for this asset class?’. Retrieved from YouTube.

10 Milman, D. (2022). ‘The history of Ccohousing’. Retrieved from Canadian Cohousing Network.

11 Global Wealth Group. (2021). ‘Industry snapshot: a look into co-living in Australia’. Retrieved from Wealth Migrate.

12 Global Wealth Group. (2021). ‘Industry snapshot: a look into co-living in Australia’. Retrieved from Wealth Migrate.