Wealth Migrate

Your Account

Investing

Your Portfolio

Company

Performance Reports

2020

Resources > Company

We at Wealth Migrate adhere to our values of trust, transparency, and alignment and are thus excited to share an overview of our portfolio performance for the 2020 calendar year.

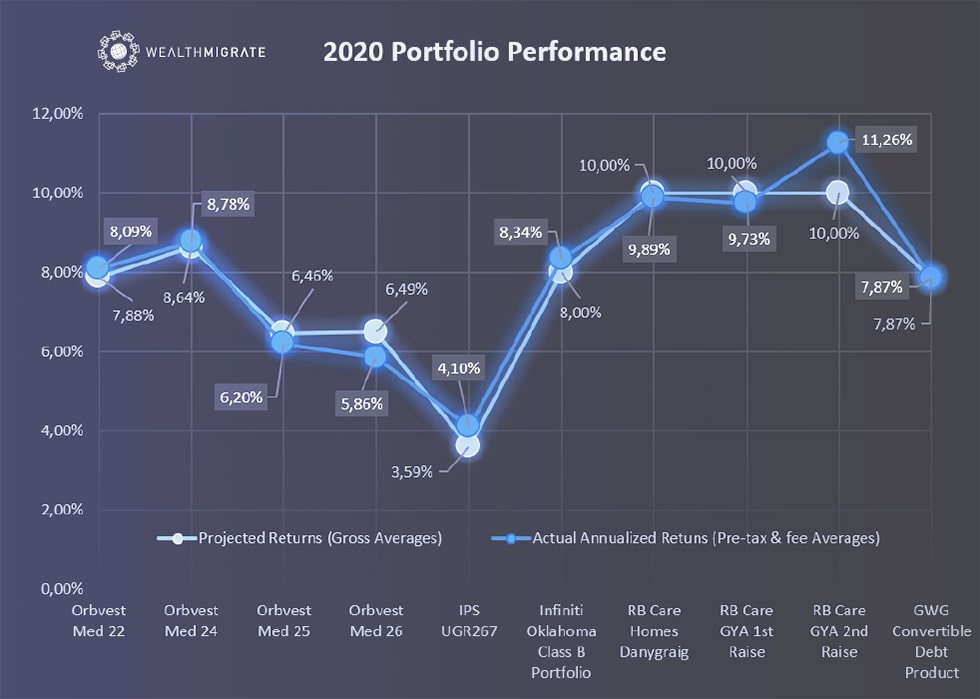

We are happy to report that all ten deals included in our 2020 portfolio were well in line with their projected returns for the year. Despite all the challenges that 2020 presented, we are grateful that none of our portfolio deals showed any significant down-side deviations from their expected returns.

This report does not include any independent or white label deals as it focuses exclusively on our portfolio of deals that were active during 2020. Please note that for fair comparability to their projections, all returns displayed in this report were calculated on a pre-tax and pre-fee basis as declared by our various sponsors. This means that your personalized returns might differ slightly from the results shown below as no adjustments for tax nor transaction fees (including banking fees, processing fees, or other investor-facing fees) were accounted for in the returns stated below.

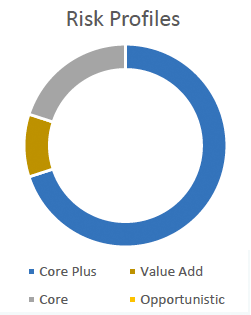

Wealth Migrate is pleased to report that half of our 2020 portfolio deals slightly outperformed their targets, while the remaining 50% produced returns that were either at or just below their annual targets. Our largest downside deviation for the year was a Value-Add offer, in terms of the deal’s risk profile, with only 63 basis points (bp) or 0.63% short of its projected annual return. Please note that this is still well within our acceptance criteria.

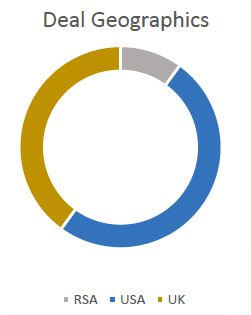

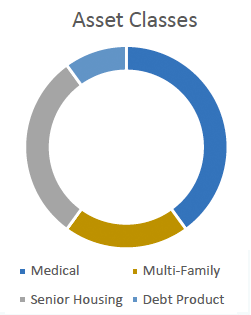

Portfolio Composition as at the end of 2020

As any investment entails a certain degree of risk, we specifically want to acknowledge our sponsors for the quality deals that they bring to our community. Although reasonable variations between the actual and targeted returns are present, we are grateful that our trusted sponsors were able to deliver on their forecasted returns, despite the difficult year that 2020 turned out to be.

We are proud to share a growing portfolio with our community, prospective investors, and shareholders

8.01%

portfolio average COC for 2020 against an overall projection of 7.89%.

4.2 years

average investment term.

$464 403

distributed during 2020 in the form of dividends, interest, and return of capital.

Portfolio Breakdown Per Sponsor

Orbvest:

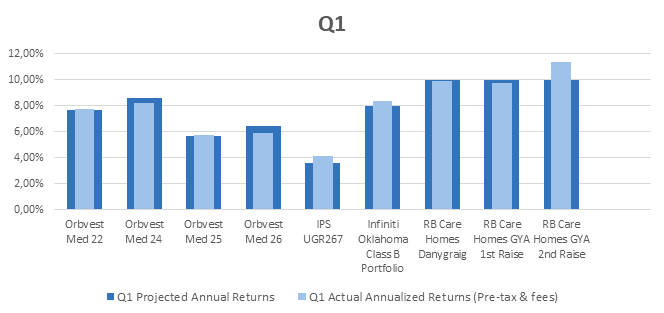

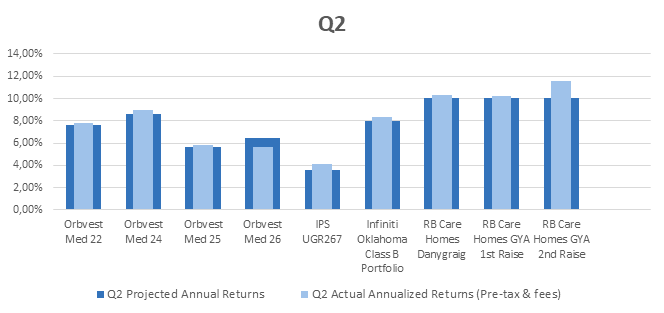

All four of our USA-based Medical deals performed well and were in line with their projected returns for the year. Med-22 (core-risk profile) and Med-24 (core-plus-risk profile) both exceeded their targets, with 21bp and 14bp, respectively. Med-25 (core-plus-risk profile) and Med-26 (value-add-risk profile) performed slightly worse, but only missed their targets for the year with 26bp and 63bp, respectively. The performance of Med-26 was affected by delays in tenant installations during lockdown, while Med-25 faced delays in permit approvals required to complete its parking garage. Due to a few rental deferrals and the above-mentioned delays, Orbvest funded certain distributions from reserves. Although the parking garage has since been completed, Orbvest deemed it best to follow a more conservative distribution approach by delaying return ramp-ups until income improves and their reserves have been built up again. Orbvest is prioritizing its distribution waterfall in 2021 to resolve these temporary disruptions and catch up on all dividends in arrears.

IPS:

UGR267, a UK-based Multi-family deal with a core-risk profile, outperformed in all four quarters and exceeded its annual forecasted return with 51bp. All three of the flats forming part of this property are tenanted and all rental payments for the year are up to date.

Infiniti Investments:

Oklahoma Class B Portfolio, a USA-based Multi-family deal with a core-plus-risk profile, outperformed its annual expected return with 34bp. This outperformance was achieved during all four quarters of 2020.

Global Wealth Group:

The Global Wealth Group’s Convertible Debt Offering, which is a South African-based debt product with a core-plus-risk profile, started generating interest income during Q4 of 2020. This Convertible Debt Offering’s interest payments vary between 7% and 10% per annum, depending on the investment amounts and date of receipt thereof. While the majority of our 2020 investors earned 8% in annualized interest, a weighted-average return of 7.87% was derived for the year, after taking the relevant 7% interest-generating investments into account. Overall, this offering therefore met its 2020 target, and some investors are already earning up to 10% in annualized interest during Q1 of 2021, as agreed.

RB Care Homes:

Our RB Care Homes deals are UK-based, Senior Housing offerings with core-plus-risk profiles – consisting of two underlying properties namely, Danygraig and Glen Yr Afon (GYA). Kindly bear in mind that currency fluctuations between the GBP (earned) and USD (distributed) played a role in the distributions of these Age-Care offerings. Fortunately, the foreign exchange rate between the GBP and USD mostly played in favour of our investors’ returns.

Divergences in the returns of GYA’s first and second raises are specifically notable, as their exchange spot rates differed at the time of conversion. Please note that the two raises for GYA should be seen as two separate deals as the investments were not made on the same dates and subsequent distributions were received on separate dates. As a result, distinct exchange rates were applied to both the initial investment, as well as the respective distribution points of each deal.

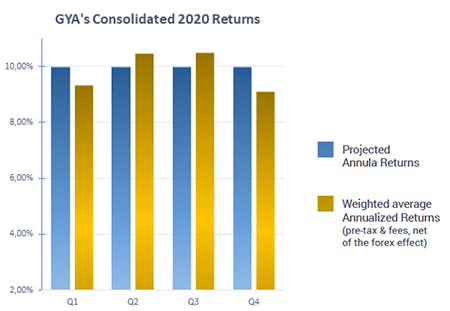

Despite this forex effect, the combined returns were still in line with the deals’ projected 10% returns. In the diagram to the right, kindly note the time-and-money-weighted-average returns where GYA’s two raises were consolidated.

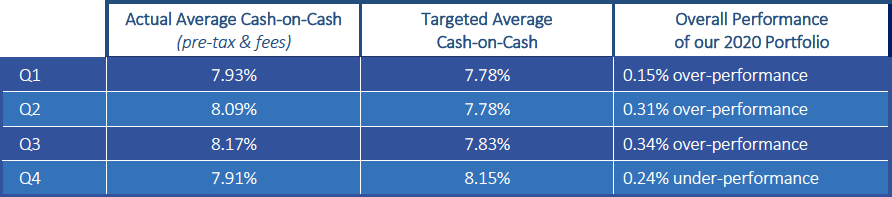

2020 Quarterly Breakdown:

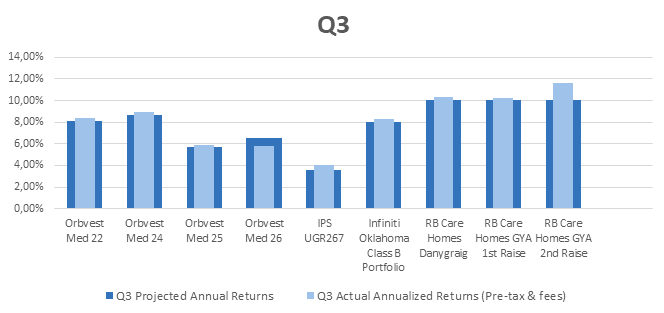

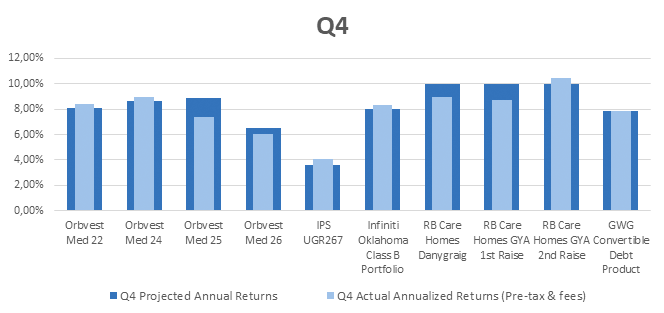

Below are visual representations of each quarter’s annualized performance per deal:

Five of the nine deals forming part of our Q1 portfolio exceeded their estimated annualized returns. During Q2 and Q3, our portfolio of deals continued to outperform, with the exception of Med-26. During Q4, the Convertible Debt Product was added to our portfolio of deals and achieved its expected returns for the quarter. Although the portfolio in Q4 marginally missed its overall target with 24bp, half of the deals included in the portfolio still outperformed.

Looking ahead

In addition to the ten deals presented in this report, we have since added eight more investment offerings to our platforms – half of which has already been fully funded by our community. We have also onboarded four new institutional-quality sponsors this year, domiciled in America and Europe. Our Supply Team is actively in the process of sourcing and scoping further partnerships with various industry experts to bring you as an investor plenty of exciting opportunities, in both the real estate and alternative investment spaces.

Disclaimer

The content and information being shared by Wealth Migrate via this presentation are for information purposes only and should not be construed, under any circumstances, by implication or otherwise, as advice of any kind or nature, or as an offer to sell or a solicitation to buy or sell or trade in any commodities, securities, or currencies herein named. Information is obtained from sources believed to be reliable but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

In no event should the content of the information being shared be construed as an express or implied promise, guarantee or implication by or from Wealth Migrate or any of its officers, directors, employees, affiliates or other agents that you will profit or that losses can or will be limited in any manner whatsoever. Any investments made in light of these ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk. Wealth Migrate is not an investment advisor, workshops are for informational purposes only and not a recommendation to invest in any real estate or to buy or sell any securities and it is the responsibility of each investor to obtain prior independent financial advice prior to making any investment.

Attendees agree to hold harmless the presenter, publisher and or Wealth Migrate personally and collectively for any loss, if any, that may result from the use of the information shared. Past performance may not be indicative of future results. Future results can be dramatically different from the opinions expressed. Past performance does not guarantee future performance.

Please obtain the advice of a competent financial advisor before investing in any financial instrument or product. It is strongly recommended that you consult with a licensed financial professional before using any information provided during this workshop. Any market data or news commentary used here is for illustrative and informational purposes only. Although it may provide information relating to investment ideas and the buying or selling of securities, investment in real estate, you should not construe anything as legal, tax, investment, financial or any other type of advice.